Why Not Point Hedges?

When most people think of hedges, they think in broad terms like hedging an entire long equity portfolio with SPX/SPY puts or VIX calls or some similar product. The thinking is typically that it is better to have broad-based protection against a bear move in stocks and/or a spike in volatility than to build only one castle wall facing the direction in which an enemy attack is expected. More often than not, it is the unexpected that wreaks havoc on a portfolio, not the white swan that slowly morphs into ivory, then light gray, then…

I might as well say this up front: I hate hedges. I love the idea of hedges, but when it comes time to pay for one, they invariably come across as more expensive than even a reasonably effective market timing strategy. Of course, there are all kinds of hedges, from those that are limited to disaster protection insurance to those that are intended to counteract even the slightest nick to a portfolio. If I feel like I can get my hedges at a discount (Groupon, are you listening?) then I will gladly ante up and enjoy the safety net.

Now there are some out there who think that some of the risks to stocks, particularly domestic equities, are being exaggerated by most investors. Those who hold this opinion might be better served to avoid a broad-based hedge and think in terms of what I call a point hedge. Simply stated, a point hedge is a rifle approach to portfolio protection rather than a (full perimeter) castle wall approach.

Perhaps an example will help to illustrate the point hedge approach. Let’s assume that an investor thinks that the U.S. economy will do better than the doomsayers predict and even fulfill James Altucher’s prediction, which was far-fetched at the time, that the SPX will hit 1500 in relatively short order. If that’s the case, then should the rifle be aimed? Let’s further assume that this bullish investor is primarily concerned about a worsening conflict between Iran and Israel, Spanish fiscal issues starting to resemble the Greek crisis, a possible hard landing in China and the rise of cyberwarfare.

Rather than construct a broad-based hedge, it is possible to create a more cost-effective portfolio hedge by aggregating point hedges across all four areas of concern. For Iran and Israel, something like a long position in Brent crude oil (BNO) might do the trick. As far as Spain is concerned, purchases of puts in the country ETF (EWP) would be appropriate, but a more liquid and perhaps more targeted approach might be long puts in Spain’s largest bank, Banco Santander (STD). There are many alternative approaches in China, but certainly a short position in FXI or some long puts in that ETF is one approach worth investigating. Last but not least, cyberwarfare presents a different set of problems, but some of the firms where call purchases might be hedges against a spike in cyberwarfare are SAI, CHKP, FIRE, FTNT and SYMC.

Of course this is just one of many potential list of threats to the stock market and possible point hedges that might be used to counteract them. Even if you prefer the blanket coverage of a broad-based hedge, it is usually worth the time and effort to draw up a list of potential threats and stocks/ETPs that might be employed to counteract those threats or perhaps even provide some speculative gains.

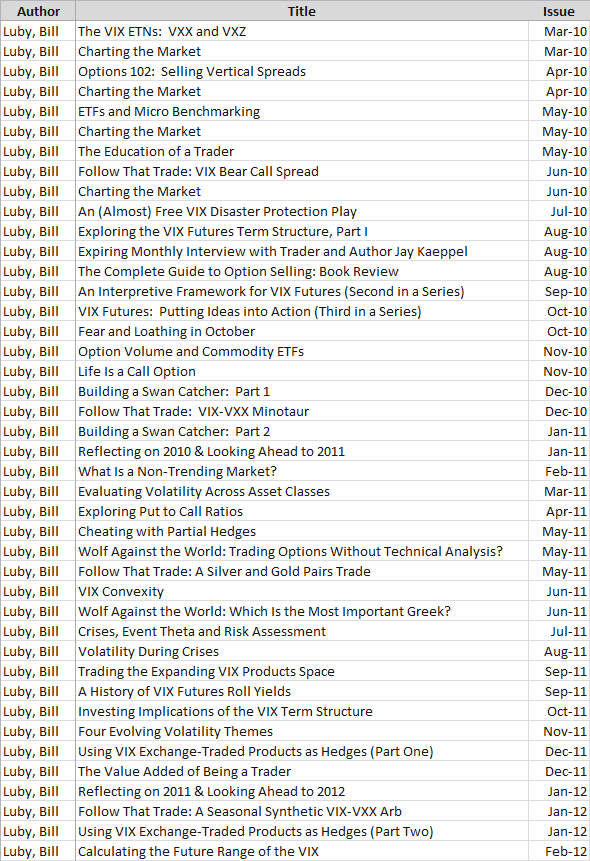

On a related note, I realize that I have only periodically been applying the “hedging” label to my posts, so I reviewed quite a few posts in the archives and have begun to retroactively apply that label to those posts (such as several in the list below) which might be of particular interest to financial archeologists.

Related posts:

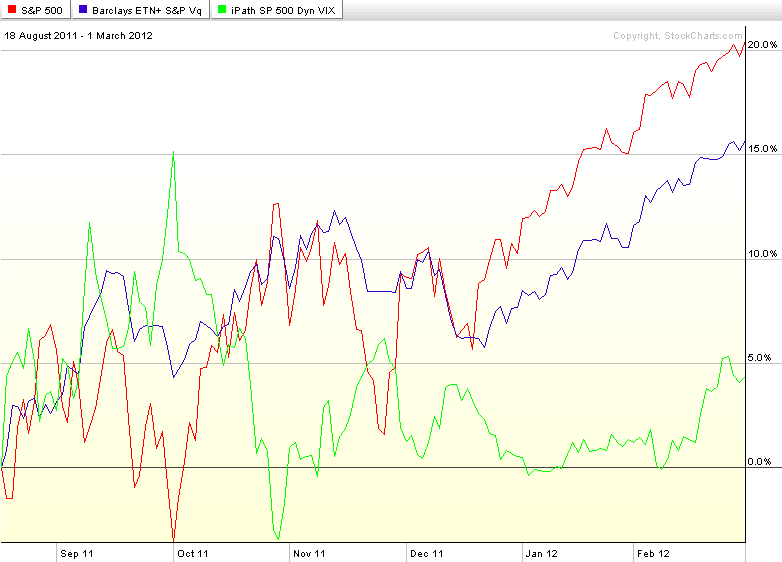

- Dynamic VIX ETPs as Long-Term Hedges

- Comparing SPLV and VQT

- Three New Risk Control ETFs from Direxion

- The Case for VQT

- The Year in Safe Havens

- The VIX as a Hedging Tool

- Global Bank Stocks in a Post-Lehman World

- Reflections on Investing Ten Years Ago

- The Dangers of Anticipating a Market Reversal

- Availability Bias and Disaster Imprinting

- The Gap Between the VIX and Realized Volatility

[graphic: Scaliger Castle, Sirmione, Italy – Library of Congress]

Disclosure(s): long FIRE at time of writing