An Updated Field Guide to VIX ETPs

With the sudden success of TVIX, it seems as if the entire VIX exchange-traded product (ETP) space has a large number of new converts. Growing from just two products at the end of 2009 (VXX and VXZ) to 12 by the end of 2010 and 31 by the end of 2011, VIX ETPs are a growth industry.

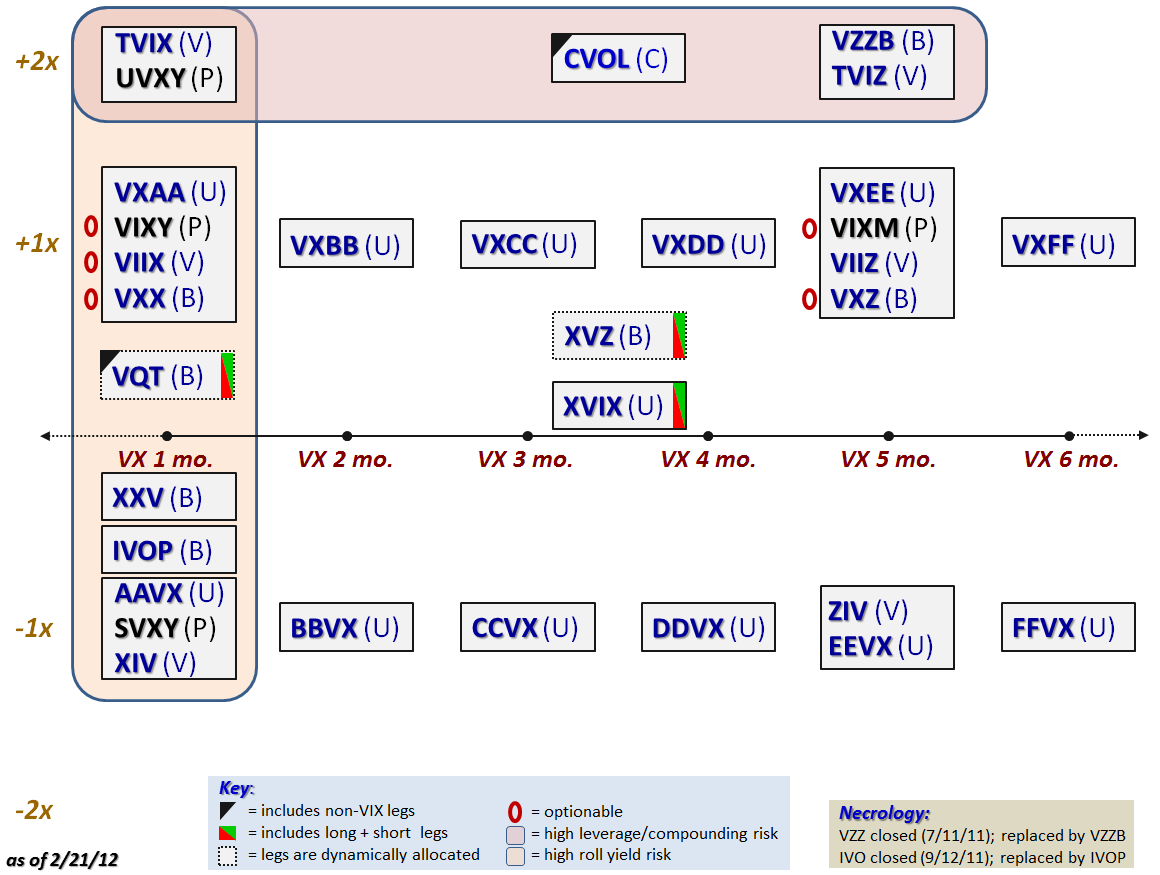

For those who trade or invest in the VIX ETP space, I thought the graphic below – a field guide of sorts – might be of assistance. The intent of the graphic is to differentiate between the various VIX and volatility-based ETPs primarily by mapping them according to target duration and leverage. The key at the bottom of the graphic highlights some additional distinctions, such as:

- ETPs that hold some non-VIX securities in their portfolio are marked by a black triangle. These include VQT and CVOL, which hold long or short positions in SPX/SPY

- ETPs that include both long and short VIX positions in their portfolio (VQT, XVZ and XVIX) are flagged with a red/green rectangle

- ETPs with a dotted outline (VQT and XVZ) have a rule-based dynamic allocation of volatility components

- the red ovals highlight those five VIX ETPs that are currently optionable

- the large light red shaded area incorporates all the ETPs that use 2x leverage (there are no 3x VIX ETPs)

- the large orange shaded area incorporates all the ETPs which have a target average weighted one month duration and thus are particularly susceptible to the influence of contango and negative roll yield in the VIX futures portion of their holdings

There are some other important distinctions that are difficult to work into the chart, but one I did incorporate was to flag VIX ETFs (from ProShares) in a black font, while all the ETNs are in a blue font.

For the sake of completeness, I also included a necrology of the two VIX ETPs that were closed last year. Interestingly, both were immediately succeeded with virtually identical products that trade under a similar ticker.

Going forward I fear that the next round of VIX ETPs may make it impossible to capture the same level of detail as I have done in this single page, but for now at least, this is my reference of choice for VIX ETPs.

Related posts:

- VIX Exchange-Traded Products: The Year in Review, 2011

- Four Key Drivers of the Price of TVIX

- Slicing and Dicing All 31 Flavors of the VIX ETPs

- Now Sixteen Volatility ETPs, Four of Which Are Optionable

- Two More VIX ETNs Make it a Baker’s Dozen

- Impressive Launch for Sextet of New Volatility ETNs from VelocityShares

- VelocityShares Jumping in to VIX ETP Space with Leveraged and Inverse Products

- The Evolving VIX ETN Landscape

- Interesting New Leveraged Volatility ETN Coming from Citi

- Shorting VXX and Long XXV or XIV

- Charting the Assets of Volatility-Based ETPs

Disclosure(s): long XVZ, short VXX and short TVIX at time of writing