VIX ETPs Flash Some Green in 2016

Two new VIX ETPs entered the fray in 2016: VMIN and VMAX. While these products have not yet attracted the interest of investors that I believe is warranted (VMAX and VMIN Poised to Be Most Important VIX ETP Launch in Years), there is still time for investors to discover these products. For the record, VMIN was launched on May 2, 2016 and outperformed both XIV and SVXY from the launch date until the end of the year, racking up an impressive 80.5% return in just eights months of trading. Going forward, I would expect VMIN to regularly be the top performer in any period in which the inverse ETPs post positive returns.

Related posts:

- The Year in VIX and Volatility (2016)

- The 2016 VIX Futures Term Structure: Extraordinarily Average

- My Low Volatility Prediction for 2016: Both Idiocy and Genius

- Every Single VIX ETP (Long and Short) Lost Money in 2015

- Performance of VIX ETPs in 2013

- Performance of VIX ETPs During the Recent Debt Ceiling Crisis

- VIX ETP Performance in 2012

- Expanded Performance of Volatility-Hedged and Related ETPs

- Performance of Volatility-Hedged ETPs

- Performance of VIX ETP Hedges in Current Selloff

- Comparing SPLV and VQT

- ZIV Undeservedly Neglected

- Will TVIX Go To Zero?

- Four Key Drivers of the Price of TVIX

- Credit Suisse Suspends Creation Units in TVIX: What It Means

- TVIX Creation Units Return: What It Means for Investors

- All About UVXY

- The Case for VQT

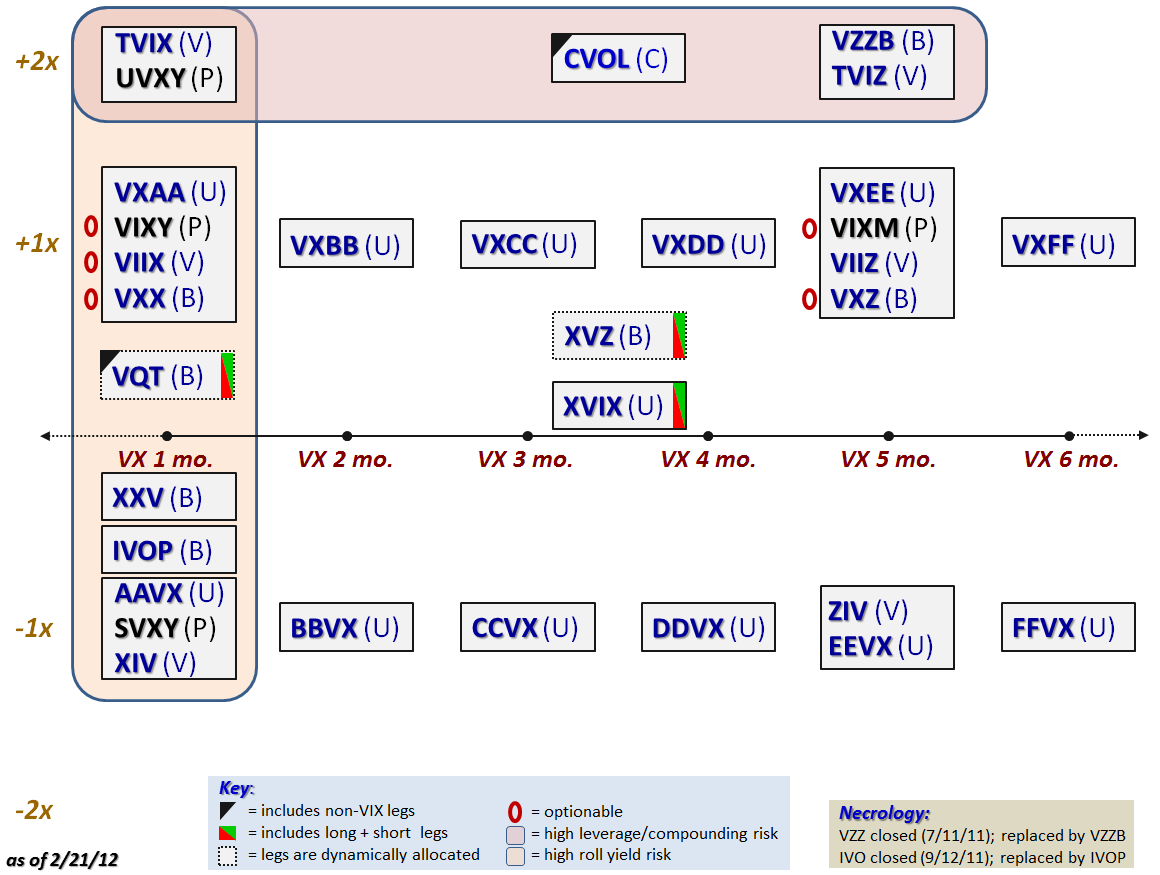

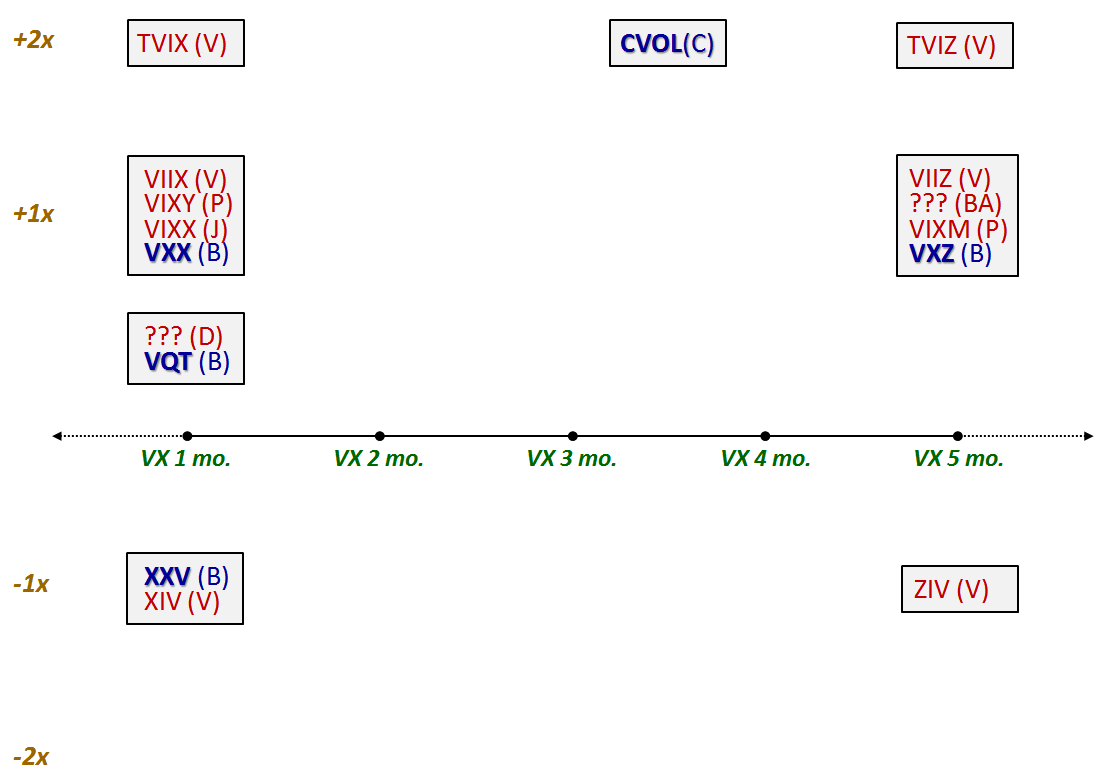

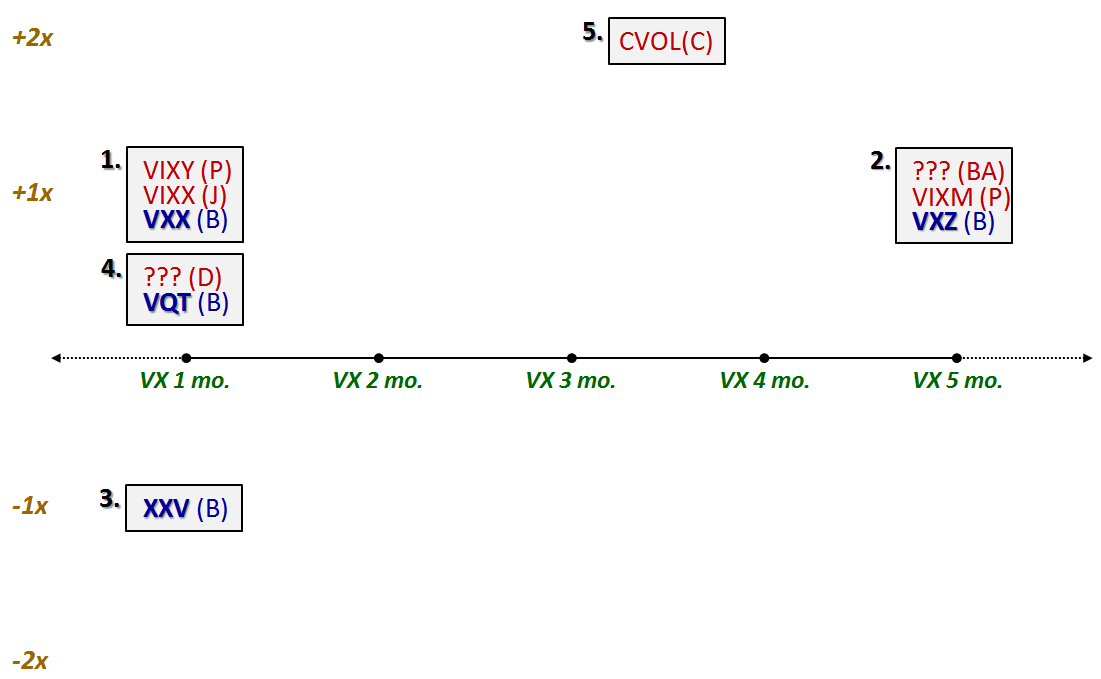

- Slicing and Dicing all 31 Flavors of the VIX ETPs

- Charting the Assets of the Volatility-Based ETPs

- Why VXX Is Not a Good Short-Term or Long-Term Play

- VXX Calculations, VIX Futures and Time Decay

- First Day of Trading in VXX and VXZ a Success