Two More VIX ETNs Makes It a Baker’s Dozen

In addition to the six new VIX-based ETNs launched yesterday by VelocityShares, two new VIX-based ETNs also traded yesterday for the first time.

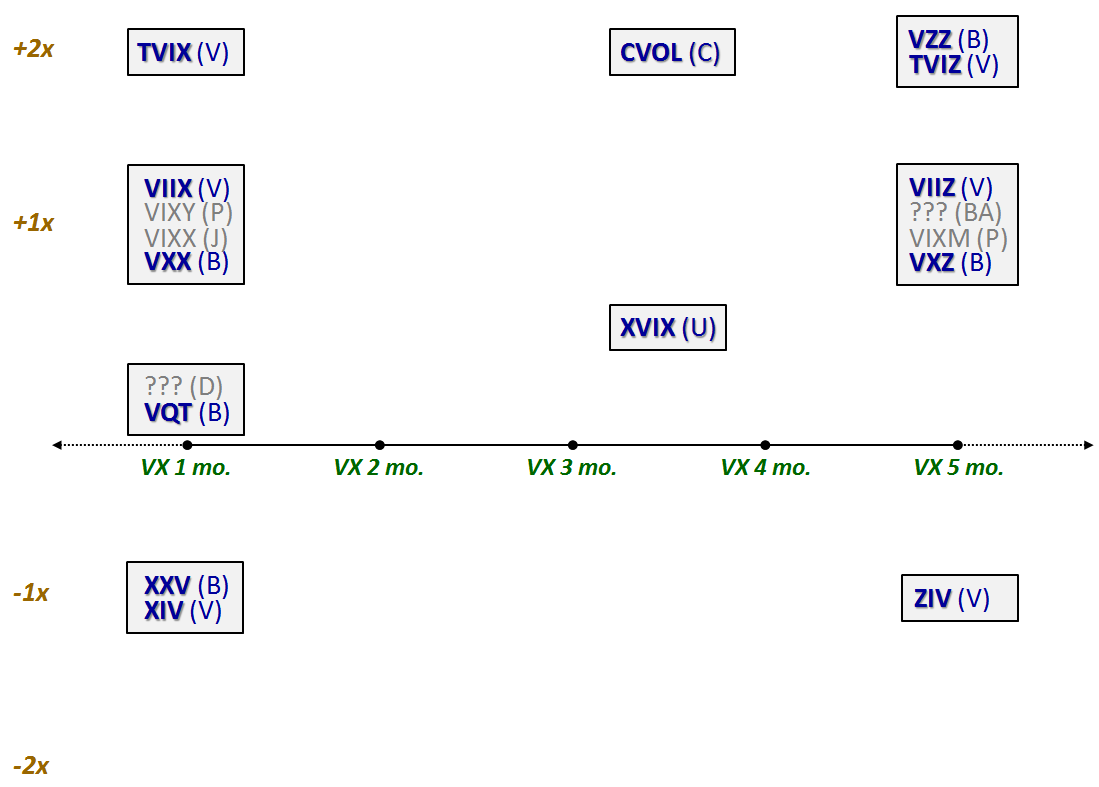

Barclays added VZZ to their product lineup, bringing the total number of Barclays products in the space to five. VZZ is essentially a +2x version of VXZ, with a target maturity of five months. VZZ is the first leveraged volatility ETN from Barclays and is interesting in that the absence of a corresponding +2x VXX product suggests Barclays does not see the need for a leveraged VXX equivalent or perhaps finds the combination of leverage and high contango at the front end of the VIX futures term structure to be a daunting combination.

Elsewhere, UBS makes its entry into the VIX-based ETN fray with a huge splash. Their new product, XVIX, ups the innovation ante by combining a 100% long position in the S&P 500 VIX Mid-Term Futures Excess Return Index with a 50% short position in the S&P 500 VIX Short-Term Futures Excess Return Index. Translated into Barclays terms, this would be roughly the equivalent of two units long VXZ and one unit short VXX. Depending upon the shape of the VIX futures term structure, UBS is hoping that XVIX will benefit from contango and also get a lift from an increase in volatility. The performance of XVIX going forward will be particularly interesting to watch.

I would expect the land grab in the volatility ETP space to settle down for a little while as investors evaluate the new menu of options. In the meantime the chart below should help. I have grayed out those products which have been announced, but not launched.

The most difficult part may be unlearning Roman numerals in the process. I’m sure on some trading floor, however, some joker is yelling out, “I’m long 25 and 15, but short 70.”

Related posts:

- Impressive Launch for Sextet of New Volatility ETNs from VelocityShares

- VelocityShares Jumping in to VIX ETP Space with Leveraged and Inverse Products

- The Evolving VIX ETN Landscape

- Interesting New Leveraged Volatility ETN Coming from Citi