Slicing and Dicing All 31 Flavors of the VIX ETPs

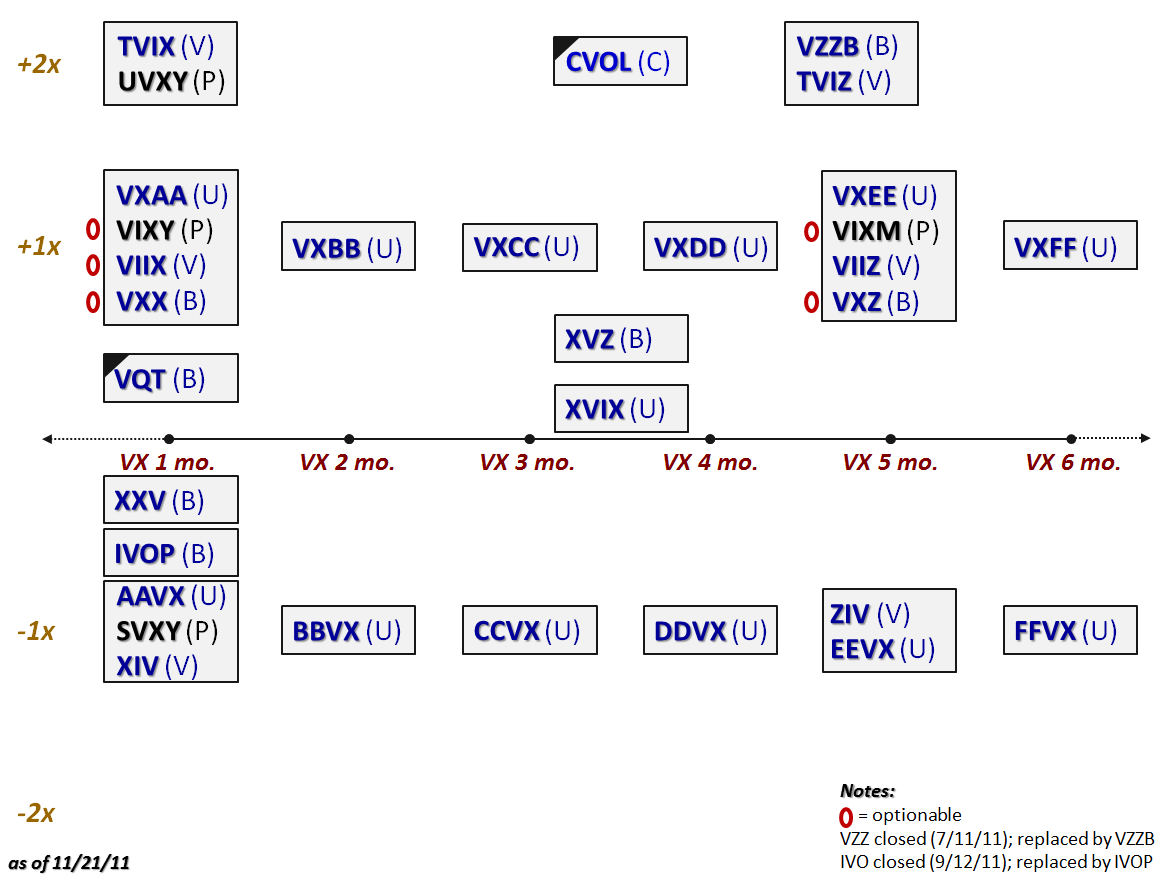

Ten months have passed since the last time I attempted to graphically depict all the VIX-based exchange-traded products. At that time there were 16 such securities; now that number has swelled to 31 and two have closed their doors (IVO and VZZ) along the way.

The graphic below attempts to map the herd onto an x-axis for target duration and a y-axis for leverage. In addition to these important criteria, I have also further delineated the group by identifying the four ProShares ETFs in black (the balance are all ETNs), highlighting the five optionable ETPs with a red O preceding their ticker and flagging the two VIX ETPs that have some non-VIX components (in the form of the S&P 500 index) with a black triangle. For good measure I have identified the issuer with a parenthetical one letter abbreviation (Barclays,VelocityShares, ProShares and UBS).

It is worth noting that earlier in the month S&P and VelocityShares announced several new VIX futures strategy indices that hint at future VIX ETPs, all of which will include both a long leg and a short (inverse) leg.

The VIX ETP space is already an exciting one, with over $2.1 billion in assets and daily volume of over 45 million shares per day. As exciting as 2011 has been in this space, things look to be heating up even more in 2012.

Related posts:

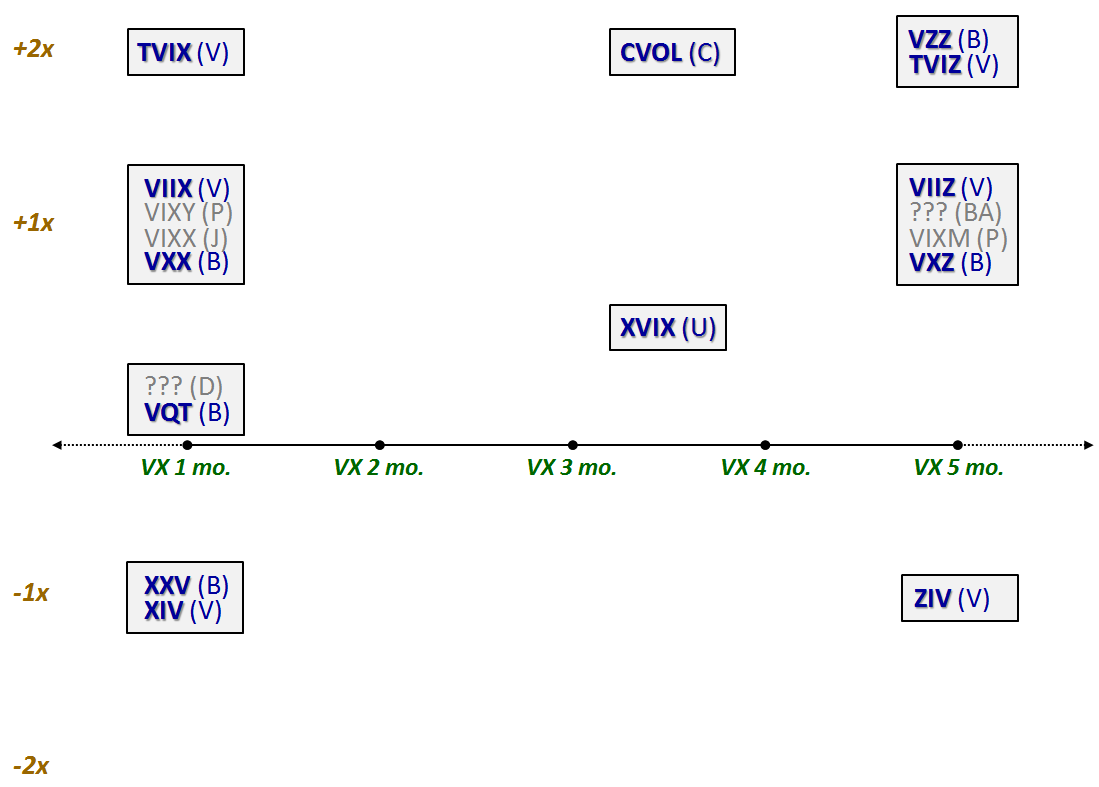

- Now Sixteen Volatility ETPs, Four of Which Are Optionable

- Two More VIX ETNs Make it a Baker’s Dozen

- Impressive Launch for Sextet of New Volatility ETNs from VelocityShares

- VelocityShares Jumping in to VIX ETP Space with Leveraged and Inverse Products

- The Evolving VIX ETN Landscape

- Interesting New Leveraged Volatility ETN Coming from Citi

- Shorting VXX and Long XXV or XIV

Disclosure(s): none