LSC Long-Short Commodities ETF Struggling Mightily

Launched in June 2008, the ELEMENTS S&P Commodity Trends Indicator ETN (LSC) was an immediate hit with retail investors, attracting a considerable volume, offering diversification from an equity-heavy portfolio and even using a long-short approach to take advantage of both bullish and bearish trends in commodities. By the end of the 2008, the ETF was already up more than 6%.

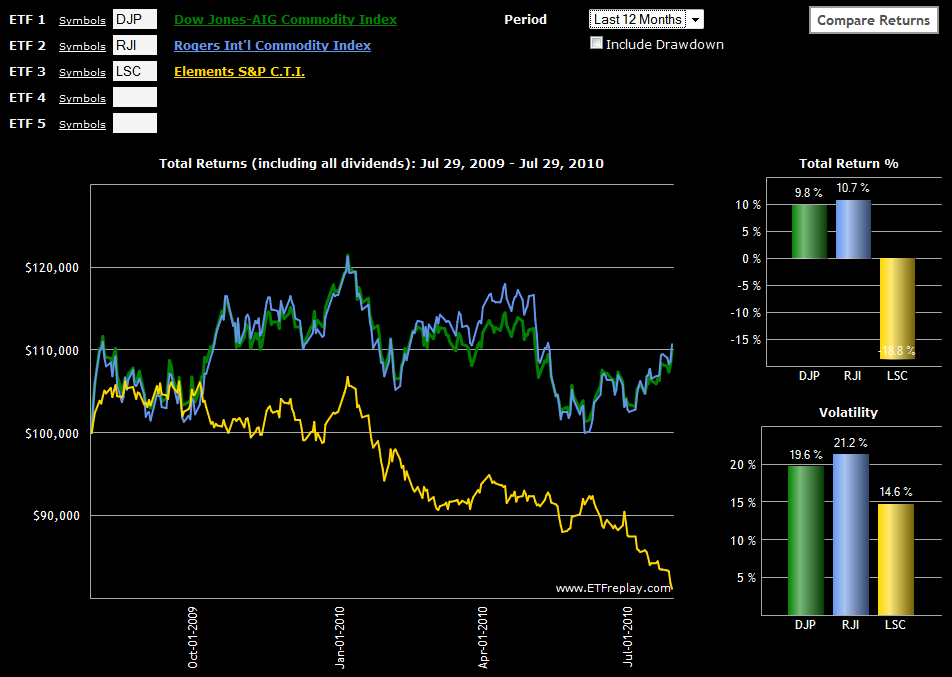

Unfortunately, since the end of 2008 the ETF has been steadily losing ground and is now down 44% from its 2008 high water mark. The graphic below, from ETFreplay.com, shows LSC’s performance relative to broadly diversified commodity ETFs, RJI and DJP over the course of the last year. While the graphic alone may make LSC appear to be an attractive short, I think it is important to note that the prospectus has historical data going back to 2001 which shows excellent long-term performance characteristics.

A look under the hood shows that LSC’s trend following approach uses a 7-month exponential moving average (EMA) to evaluate trends in the following 16 commodity futures contracts:

- Wheat (CBOT: W)

- Corn (CBOT: C)

- Soybeans (CBOT: S)

- Cotton (NYCE: CT)

- Cocoa (CSCE: CC)

- Sugar (CSCE: SB)

- Coffee (CSCE: KC)

- Live Cattle (CME: LC)

- Lean Hogs (CME: LH)

- Copper (COMEX: HG)

- Gold (COMEX: GC)

- Silver (COMEX: SI)

- Heating Oil (NYMEX: HO)

- Light Crude Oil (NYMEX: CL)

- RBOB Gasoline (NYMEX: XB)

- Natural Gas (NYMEX: NG)

Based on where the commodities are relative to the EMA, the ETF will go long or short, or have a neutral position. The one exception is crude oil, where the ETF is only allowed to be long or flat. The prospectus lays out the rationale for the short restriction on crude oil as follows:

Energy, due to the significant level of its continuous consumption, limited reserves, and oil cartel control is subject to rapid price increases in the event of perceived or actual shortages. For example, although a problem of this magnitude has not occurred historically, if the Index were capable of shorting the energy sector and a catastrophe occurred which caused Light Crude prices to surge dramatically while the energy Sector allocation was set to short, the Index would lose a significant portion of its value on the Light Crude position alone. Because no other sector is subject to the same continuous demand with supply and concentration risk, the energy sector is never positioned short in the Index.

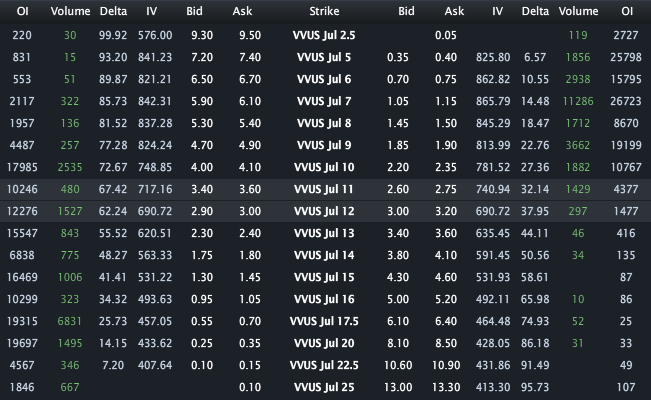

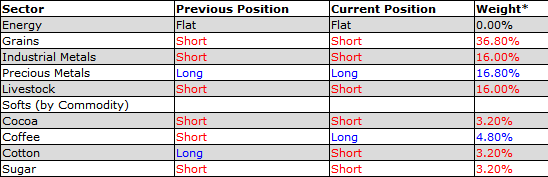

LSC evaluates all futures contracts at the end of each month and makes any new long-short decisions at that time. The current (July) positions of LSC are as follows:

Those interested in additional information on LSC should try:

Going forward, I think the “…and More” portion of this blog will begin to place increased emphasis on the commodity space, including ETFs, futures and options on commodities.

As an aside, there are two new ETF sites that have recently launched which offer a great deal of promise to ETF investors:

- ETF Prophet – a collaborative effort that includes two bloggers from my blogroll: ETF Rewind, and BZB Trader – as well as several highly regarded up-and-comers

- ETF Channel – run by the same people who are responsible for the excellent Value Forum site

For more on related subjects, readers are encouraged to check out:

- Chart of the Week: Impact of Falling Euro on Stocks and Commodities

- Chart of the Week: Commodities and the Dollar

- Chart of the Week: Breaking Out Recent Commodities Moves

- Diving a Little Deeper into Strategy-in-a-Box ETFs

- CME to Use VIX Methodology for New Crude Oil, Corn, Soybean and Gold Volatility Indices

- Some Favorite ETF Sites

[sources: ETFreplay.com, ELEMENTS/Merrill Lynch]

Disclosure(s): short LSC at time of writing