A Baker’s Dozen of Favorite Indicators

In my previous life, when I favored the currency of frequent flier miles over the Dow Jones Transportation Average itself, I used to spend a lot of time consulting in the area of business strategy development. During this period, much of my energy was focused on the creation of strategic objectives and a corresponding set of metrics that would help to determine how well those objectives were being met and how likely the were to be achieved in the coming quarters. The work was a roughly even mixture of art and science that attempted to capture the complexity of a business, yet reduce it to about 12-15 metrics. Experience proved that less than a dozen or so metrics invariably meant that important components of the strategic plan would fall through the cracks, while more than 15 metrics usually translated into a management team that was not properly focused and thinking about strategic priorities.

In my previous life, when I favored the currency of frequent flier miles over the Dow Jones Transportation Average itself, I used to spend a lot of time consulting in the area of business strategy development. During this period, much of my energy was focused on the creation of strategic objectives and a corresponding set of metrics that would help to determine how well those objectives were being met and how likely the were to be achieved in the coming quarters. The work was a roughly even mixture of art and science that attempted to capture the complexity of a business, yet reduce it to about 12-15 metrics. Experience proved that less than a dozen or so metrics invariably meant that important components of the strategic plan would fall through the cracks, while more than 15 metrics usually translated into a management team that was not properly focused and thinking about strategic priorities.

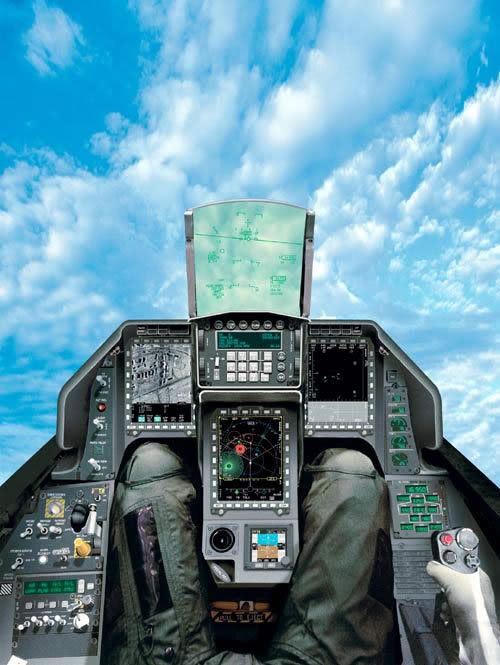

Investing, it turns out, is not much different. To the extent that you can keep things simple and have an uncluttered cockpit that still tells you everything you need to know to make it from point A to point B, you increase your chances of success.

Last week, a reader asked what my favorite market indicators are and it got me to thinking how I should be able to trade with only 12-15 indicators instead of the 25-30 that it seems I am always trying to pay attention to.

So…here is my attempt at spelling out a baker’s dozen of indicators that I would use if I were restricted to just this number:

General Market Overview:

- S&P 500 Index – with the standard 20/50/200 day SMAs

- NASDAQ Composite Index – with the standard 20/50/200 day SMAs

Market Breadth Indicators:

- McClellan Summation Index – my favorite of the advance-decline indicators

- New Highs Minus New Lows – I do a lot of work with individual stocks making new highs and like the way the 52 week high-low data complements the daily advance-decline data

Market Sentiment Indicators:

- ISEE – with a number of SMAs, including the 50 day SMA

- VIX – particularly the graph with the 10 day SMA combined with the 10% and 20% envelopes

- VWSI (VIX Weekly Sentiment Indicator) – while there is some overlap with the chart noted above, I include this because an increasing amount of my trading is driven by the VIX

Internal Market Trends / Speculative Behavior:

- Small Cap vs. Large Cap ratio – I tend to favor the RUT:OEX

- Emerging Markets vs. Developed Markets – while it hasn’t provided much in the way of exciting information as of late, I use the EEM:EFA

Three “Indicator Species” of Sorts:

- Oil – I prefer to watch the commodity, West Texas Intermediate Crude, but I also watch some of the ETFs closely

- Gold – again, I go with the commodity instead of various indices and ETFs

- The Long Bond – here I prefer TLT, the ETF for the 20 year Treasury, as I find it easiest to trade

And to Make it a Baker’s Dozen:

- Sector and Regional Strength Indicator – there are many ways to do this, but I like to sort ETFs by strength, as can be done on ETFScreen.com

Since I use Firefox, Flock and IE during the trading day, what I like to do is load all of the above indicators into tabs for my Opera start-up session, so that I can pop them open all at once just by starting Opera.

In the real world, I will likely find it difficult to wean myself away from all the other indicators that I use, but at a very minimum I urge all to prioritize their top dozen or so indicators and come up with some ideas about which ones to lean on most heavily when they are providing conflicting information and/or the markets are most volatile.

1 comments:

A worthy cockpit, and especially love your RUT:OEX and EEM:EFA ratios. Nice pic FYI.

Post a Comment