VIX Reflecting Skepticism About Rally

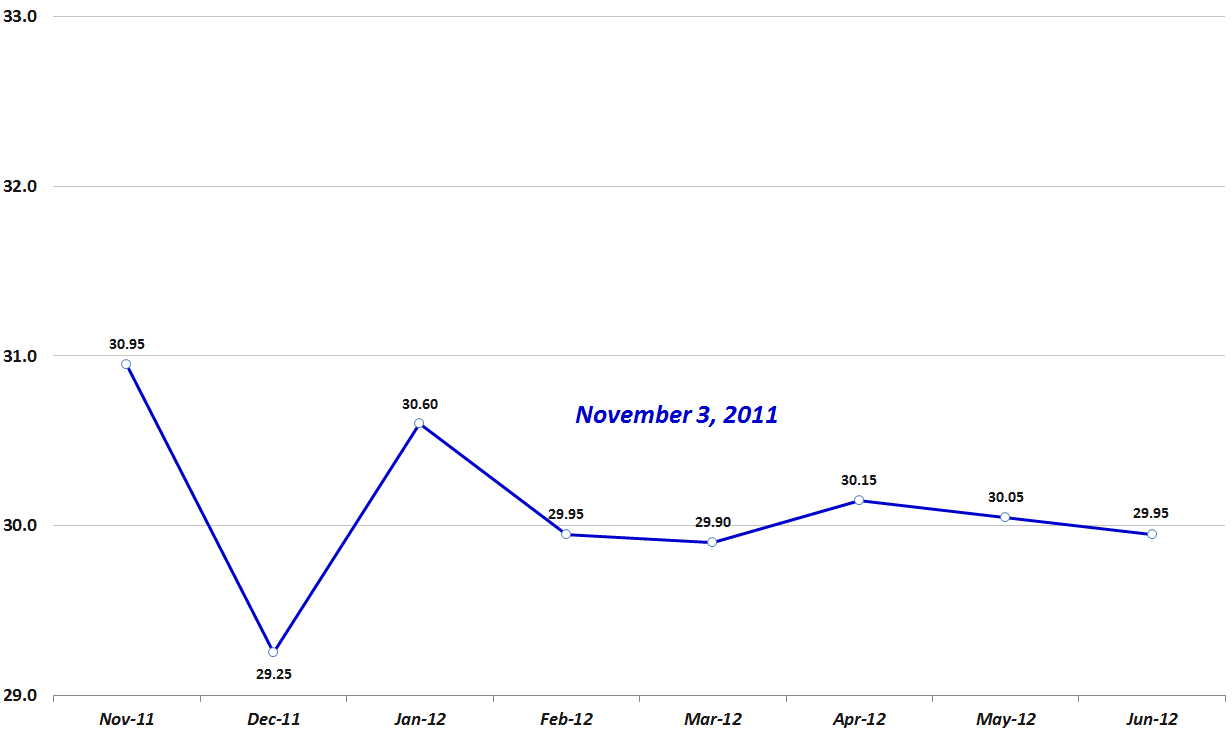

With the S&P 500 index up 3.4% as I type this and the VIX down 7.8%, it is clear that there is a fairly substantial disconnect at the moment between those who are buying stocks and those who are trading options on the SPX. The picture is even more dramatic if you look at the upward trend in both the SPX and the VIX since the open. The graphic below is not ideal for deciphering the relative movements, but the unusually high correlation between stocks and implied volatility is unmistakable when looking at today’s intraday price action.

With the VIX typically moving about 4x as rapidly in the opposite direction of the SPX under ‘normal’ market conditions, it appears as if many investors are skeptical about stocks continuing to rally in the face of ongoing uncertainty about the Europe-driven news cycle. Following an initial pop, the euro is selling off and after it dropped into the 27s, the VIX now looks content to remain above 28 for the balance of the day, the bullish action in stocks notwithstanding. One simple explanation: investors are snapping up options, including put protection, at what look like bargain basement prices.

Related posts:

- VIX Suggests Investors Don’t Believe Rally Is Sustainable

- Fearogram Maps Recent VIX Complacency

- The Week in Fear

- How Fearful Were We Last Week

- SPX-VIX Daily Correlation

- Performance Implications of VIX and SPX Divergences

- More Thoughts and Numbers on the SPX-VIX Correlation

- High Positive Correlation Between VIX and SPX Often Signals Market Weakness

[source: FreeStockCharts.com]

Disclosure(s): none