Unusual Twist in VIX Futures Term Structure as of Late

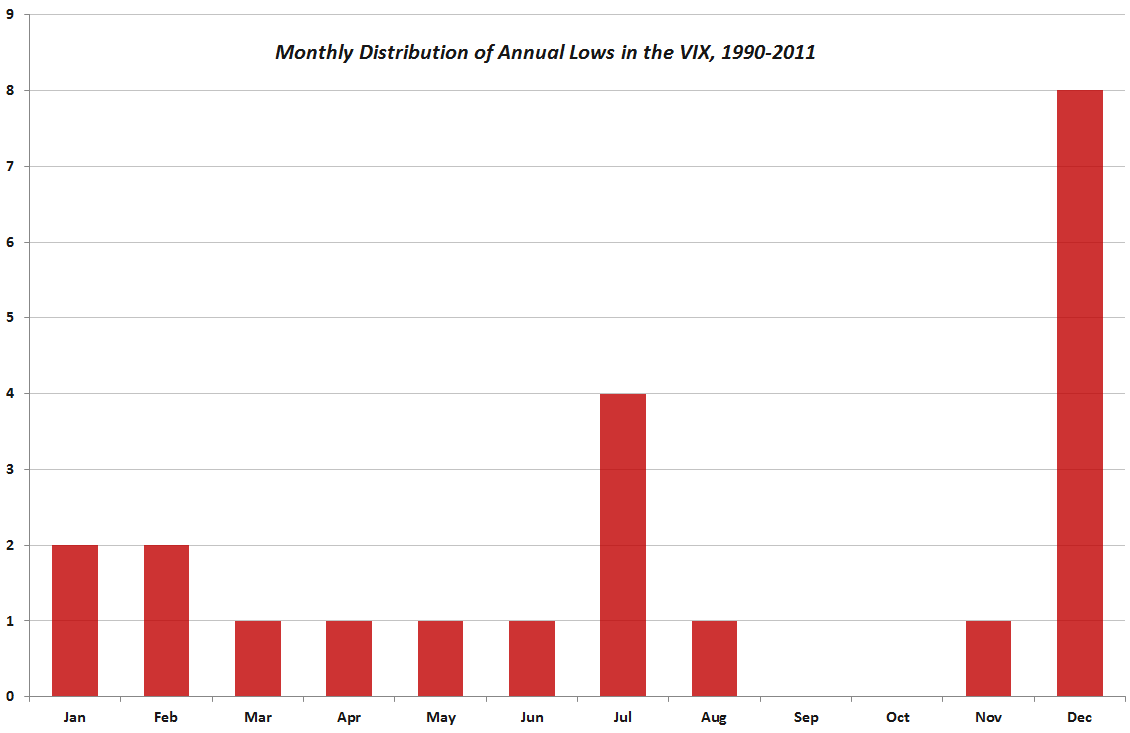

Even with the U.S. fiscal cliff grabbing all the headlines and keeping the VIX from dipping under 15, I still thought I might be able to trot out my annual series of posts on the holiday effect (or calendar reversion):

- December Is the Cruelest Month…For the VIX

- VIX and the Week Before Christmas

- Chart of the Week: Historical Volatility Plummets in Seasonal Swoon

- VIX Holiday Crush

As it turns out, fears related to the fiscal cliff have trumped the seasonal factors – at least so far – and the VIX futures term structure has twisted and turned in a decidedly unusual manner.

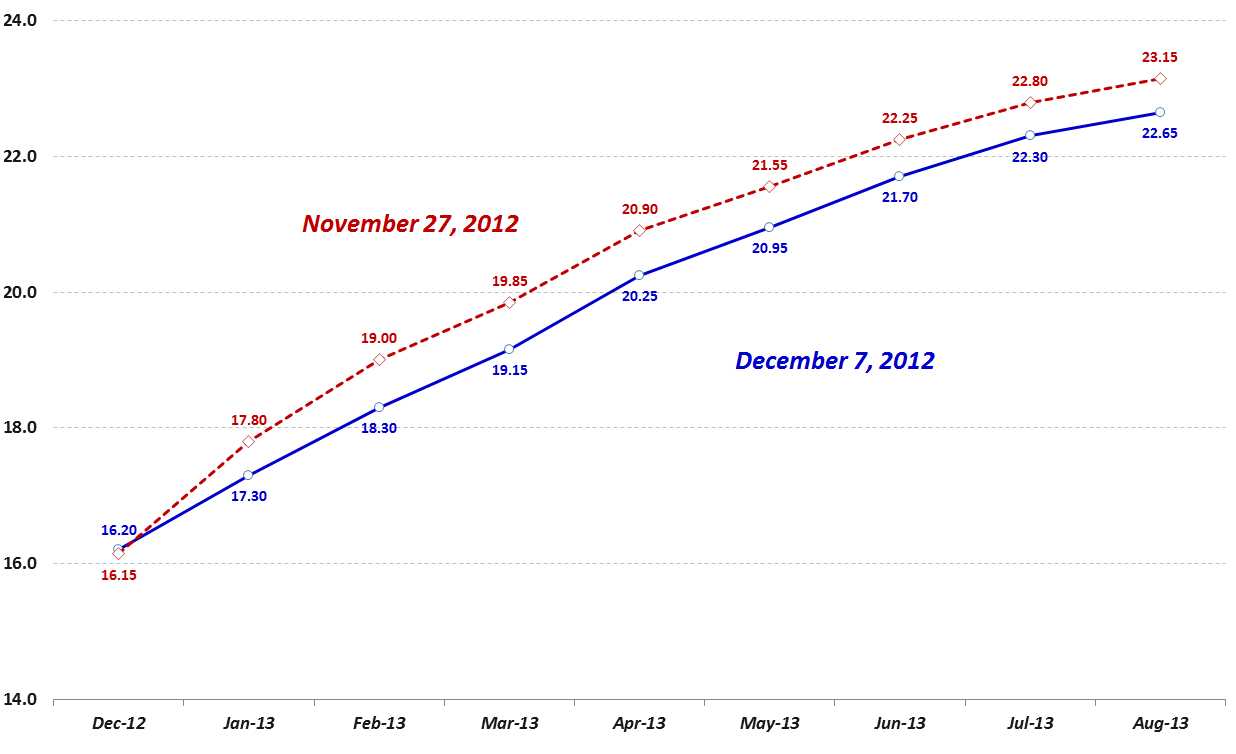

The graphic below shows the VIX futures term structure curve from November 27th (dotted red line) and again today (solid blue line), eight trading days later. Typically when there are changes in the term structure, the most extreme moves are in the front month (Dec) contract, the second largest move is in the second month (Jan) contract and so on down to the back month, which typically moves only about one third as much as the front month.

What makes the graphic below so interesting is that the front month contract is up slightly (actually up 0.05 points) while the market’s estimation of future implied volatility going out all the way to August has dropped at least 2.2% (Jul and Aug) and as much as 3.8% (Feb). What can we conclude about these changes in the VIX futures? Well, most likely investors are buying protection against a move in December (the VIX futures expire at the open on December 19th) and are selling longer-dated VIX futures contracts for February and other months in order to finance the cost of that protection. All things being said, the market is reflecting less risk in 2013, somewhat offset by a slight increase in risk and uncertainty for the next two weeks or so.

[source(s): CBOE Futures Exchange (CFE)]

Related posts:

- The 2012 VIX Futures Term Structure as an Outlier

- Violent Disagreement Across VIX Futures

- Tracking the Fall in VIX Futures

- Third Steepest First-Second Month VIX Futures Contango Ever

- VIX Futures: A Tale of Two Backwardations

- New VIX Backwardation Record

- VIX Backwardation Commentary

- VIX Term Structure Evolution Over Last Ten Days

- Capitulation in Back Month VIX Futures

- VIX Futures: What Were/Are They Thinking?

- VIX Term Structure Changes Since November 20th

- Monitoring VIX Futures and Their Impact on VIX ETPs

- VXX Calculations, VIX Futures and Time Decay

Disclosure(s): none

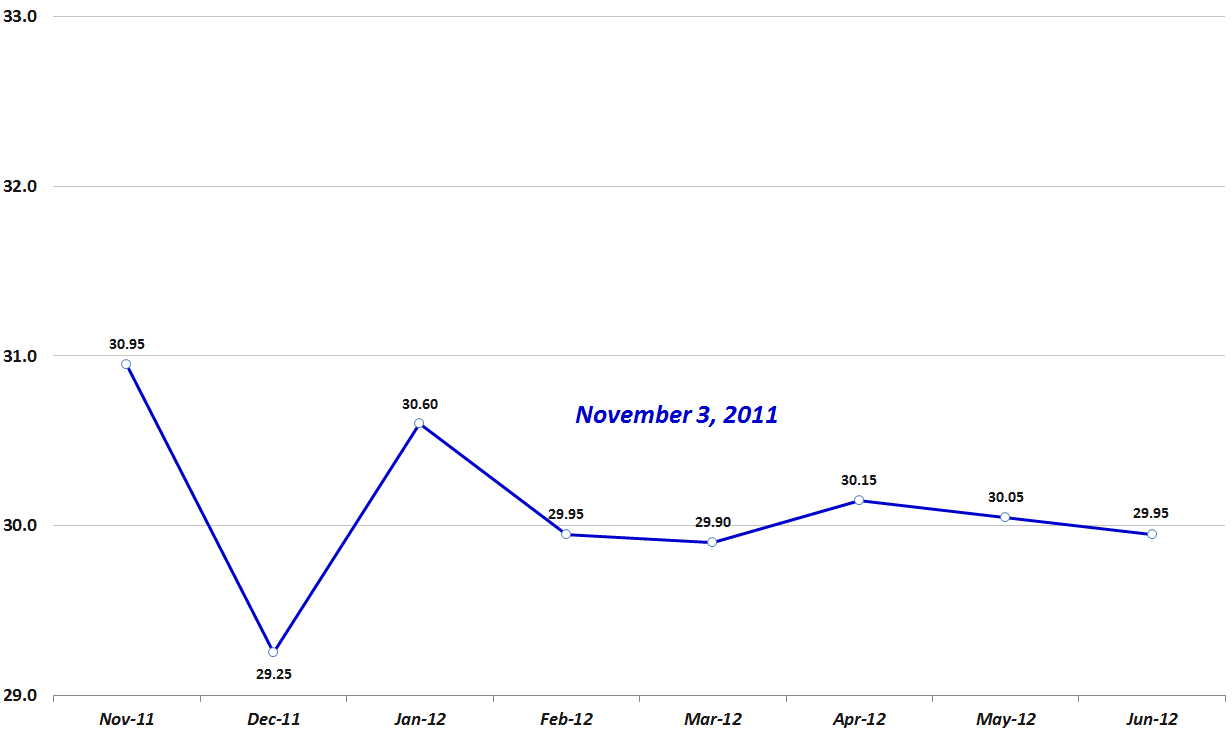

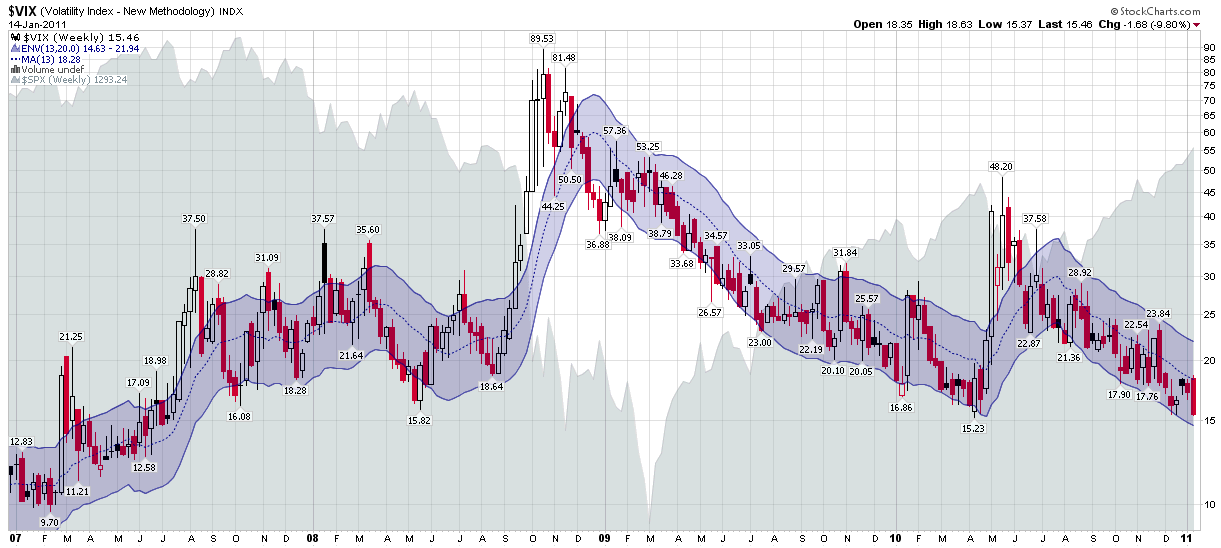

I have talked rather extensively about the surprising lack of volatility in the markets during the past month or so, particularly given the sharpness of the current downturn and the preponderance of gloom and doom news out there.

I have talked rather extensively about the surprising lack of volatility in the markets during the past month or so, particularly given the sharpness of the current downturn and the preponderance of gloom and doom news out there.