December Is the Cruelest Month…For the VIX

It seems well-nigh impossible for a December to pass without some sort of movements in the CBOE Market Volatility Index (the formal name of the VIX, for those who may have a short memory) that leave investors scratching their heads. In light of this, it appears I will be responsible for at least one December post reminding investors about the idiosyncrasies of implied volatility and the VIX during the holiday season.

There are a number of ways to look at the typical holiday swoon in the VIX, which I have labeled (the holiday effect or calendar reversion) for easy tagging and backtracking. From a strict fundamental perspective, the biggest change during the December/January holidays is fewer trading days, which means a shorter runway for stocks to depart for some unusual destinations. The other big factor is one of seasonality, specifically the tendency for December to be a bullish month for stocks.

I have chronicled how these factors influence the VIX and the strange prints they sometimes leave on the charts in posts from previous years (see links below.)

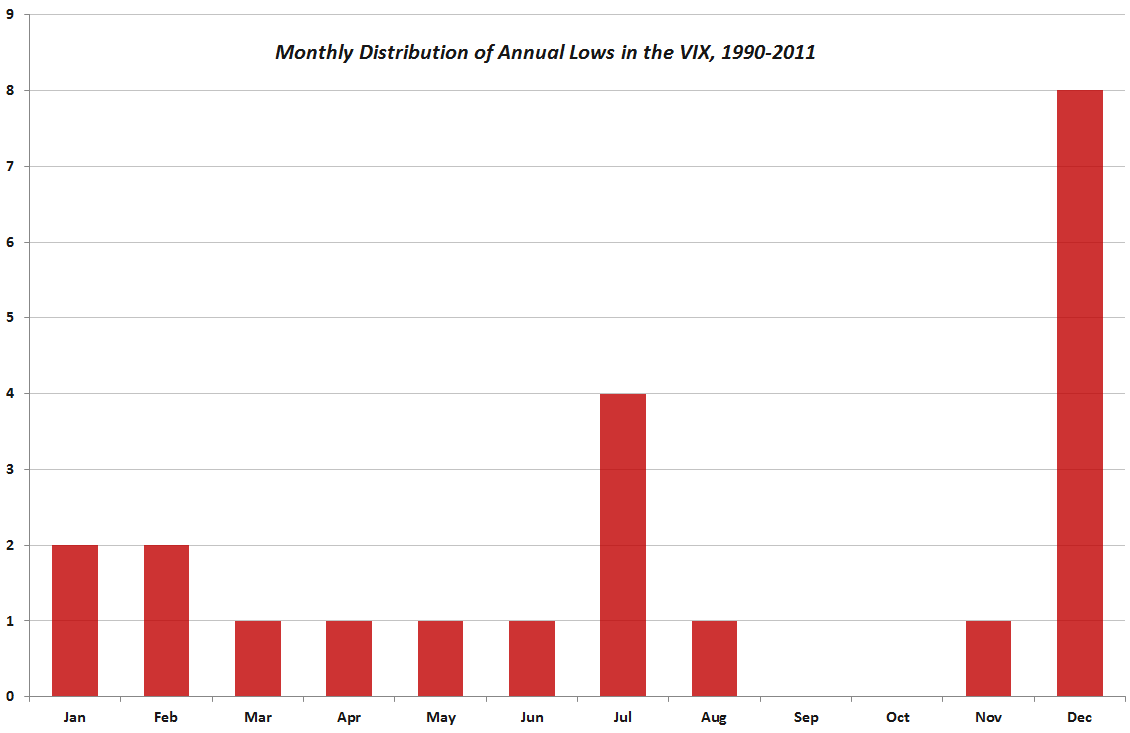

This year I am offering a chart which shows that in any given year, there is about a 40% chance that the VIX will make its annual low in December and as I discussed last year in VIX and the Week Before Christmas, the bottom usually comes in the last half of the month and most often just before Christmas.

In three trading sessions the VIX is already more than 20% off of its 30.91 close from last Thursday. It seems rather far-fetched to think that the VIX will plummet all the way below the current 2011 low reading of 14.27 from April 28th of this year (a date that is provisionally included in the chart below,) but stranger things have happened.

Even if you think the European sovereign debt crisis will see several more eruptions before the end of the year, don’t be surprised if the VIX is sleeping with the fishes for the next week or two.

Related posts:

- VIX and the Week Before Christmas

- Chart of the Week: Historical Volatility Plummets in Seasonal Swoon

- VIX Holiday Crush

- Chart of the Week: VIX Support

- VIX Put Matrix Offers Glimpse of Expected Future

- The Incredible Shrinking VIX

- Where Will the VIX Bottom?

Disclosure(s): none

[source: CBOE, Yahoo]