VIX Under 30 Five Days in a Row?

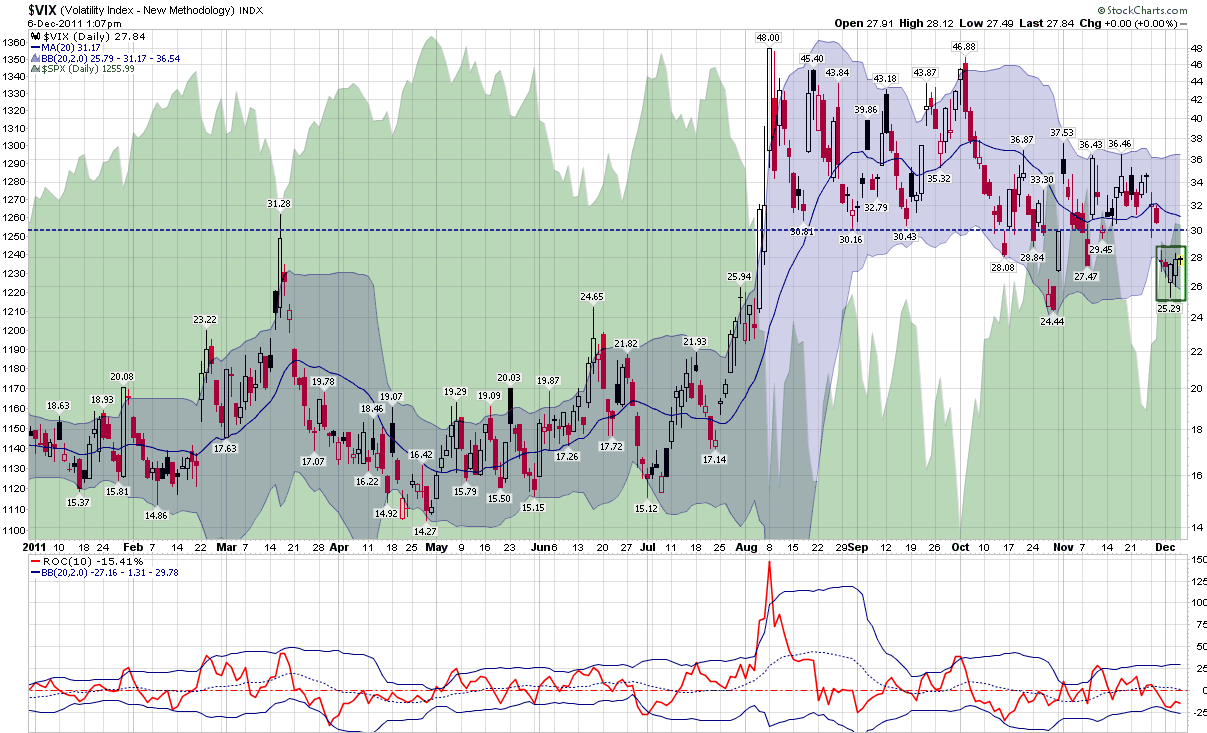

The day is still young and the rumor mill has been eerily quiet so far, but I think it is worth noting that the VIX appears ready to make it five consecutive days (green box) without breaching the psychologically significant 30.00 level (dotted black line) for the first time since July.

For those keeping score at home – or in the office – it has now been two months (as of yesterday) since the VIX has moved above the 40.00 level.

The chart below shows the path of the VIX so far in 2011, which somewhat resembles either Nessie or a cobra that has reared up and is poised to strike. Call it a Rorschach amphibian, if you will.

I have also added a 10-day rate of change study below the main chart to emphasize that while the absolute level of the VIX is important, the recent rate of change can sometimes be a better gauge of evolving market sentiment.

Given all the uncertainty surrounding a group of 17 diverse actors with very different motivations arising from divergent national agendas, economic interests and domestic political situations, it is reasonable to expect the VIX and other measures of uncertainty to climb going into the end-of-week summit. With four hours in the books, today’s action in the SPX is the tightest single-day range in five months ago. When will the next sabot fall?

[source: StockCharts.com]

Disclosure(s): none