Monitoring VIX Futures and Their Impact on VIX ETPs

This morning was one of those mornings where stocks were up, the VIX was up and some of the VIX futures were up even more than the cash VIX – at least before the latest round of news from Greece hit.

It is on days like these when my inbox invariably receives several questions from traders who are relatively new to VIX exchange-traded products (ETPs) such as XIV or ZIV and cannot understand why these are not moving with the SPX or in the opposite direction of the VIX. The answer, of course, is that these products do not track the SPX or even the cash VIX, but the VIX futures.

The reason many traders have so much difficulty with the VIX futures component of VIX ETPs is that their brokerage account is authorized for stocks and ETPs and in some cases options, but not futures. Further, most stock brokers do not have futures available to trade and a large portion of those who do allow futures trades do not have VIX futures on the menu (largely due to the regulatory split between the SEC and the CFTC, but I digress…)

So what is a VIX ETP investor to do?

Well, VIX futures quotes are always available at the CBOE Futures Exchange (CFE) on their main splash page. Unfortunately, these quotes are delayed 15 minutes.

There are, however, two popular options brokers who also have VIX futures quotes. The first of these, Interactive Brokers (IBKR), is known for their wide range of products available to trade, technology and low transaction costs. They are not known for hand-holding and high levels of customer service. If you already have an account there and know your way around or you are used to figuring out most things for yourself and are partial to a self-service model, this is probably your best bet for VIX futures quotes.

For those who are new to VIX futures and prefer to have a strong customer service safety net, a better choice is probably optionsXpress, which was acquired by Charles Schwab back in March 2011. Optionsxpress has an excellent tool set for the options trader and also has a fair amount of functionality for futures traders. Whereas Interactive Brokers excels at a low-cost self-service model, optionsXpress has more of a high touch model and charges more for the additional service component. In short, optionsXpress is likely to be a better choice for those who are new to futures and VIX ETPs.

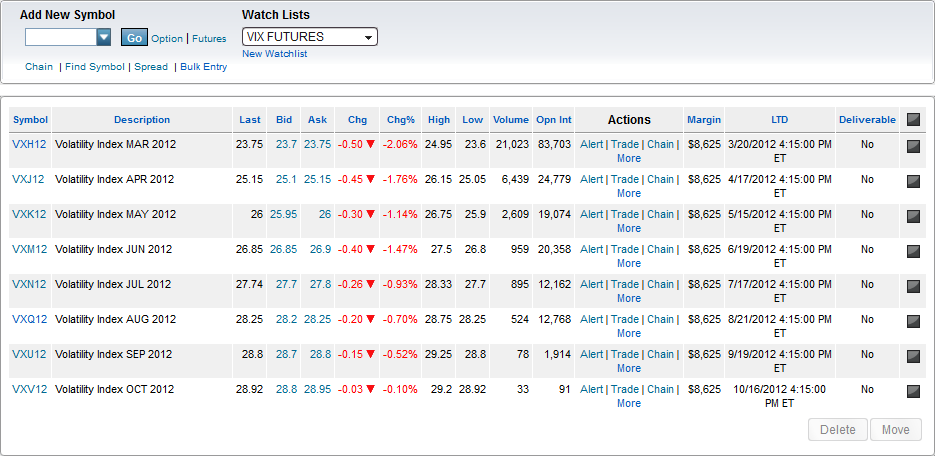

Below I have captured a (customizable) VIX futures watch list that I created in optionsXpress and have sorted by last trade date (LTD), as well as a snapshot of one of their streaming charts for the VIX March 2012 futures contract, VXH12. Note the fairly substantial amount of data, as well as a highly customizable chart.

There are other brokers out there, but my hunch is that those who are new to VIX ETPs are more likely to have an existing account with optionsXpress than any of the other stock/options brokers that also let you trade VIX futures. If not, optionsXpress is still a good place to get started in futures and specifically in VIX futures trading.

Related posts:

- VIX Exchange-Traded Products: The Year in Review, 2011

- VXX Calculations, VIX Futures and Time Decay

- Why VXX Is Not a Good Short-Term or Long-Term Play

- VIX Futures Brokers

- VIX Term Structure Evolution Over Last Ten Days

- Capitulation in Back Month VIX Futures

- VIX Futures: What Were/Are They Thinking?

[source(s): optionsXpress.com]

Disclosure(s): long XIV and ZIV at time of writing