The Biggest VIX Spike Ever: A Retrospective

Here is a thought experiment: when was the biggest one day VIX spike ever recorded? If you said February 27, 2007 – five years ago today – then I imagine you are in the distinct minority, even among active traders of VIX products.

There were a number of factors which helped to trigger the mostly forgotten record VIX spike back in 2007 – and with it a 3.5% decline in the S&P 500 index. Most media reports at the time focused on a drop in Chinese stocks. In fact, as I noted later, concerns about the Chinese government raising interest rates to discourage speculation helped to trigger an 8.8% loss in the Shanghai Composite Index and a 9.9% loss in the FTSE/Xinhua China 25 index that is the basis for the popular Chinese ETF, FXI. Various other news reports pointed to concerning U.S. economic data and there were some who were apparently spooked by a Taliban suicide bombing attack in Afghanistan that targeted Vice President Dick Cheney.

Interestingly, concerns about a sub-prime crisis or a real estate bubble were almost nowhere to be found at the time.

Of course the world was a lot different back in 2007. I had just started blogging one month before the VIX spike and in a world where a sub-10 VIX was common, I added the tongue-in-cheek tagline to the blog: “Your One-Stop VIX-Centric View of the Universe…” Twitter was in its infancy, CNBC hadn’t even thought about the idea of running a VIX ticker across your TV screen and most people didn’t even know what the VIX was at that time.

For those who may be interested in a little financial archeology, I put up eight posts that day to chronicle the magnitude of the move and offer an interpretive wrapper for those who were looking for more information:

- VIX Spikes While Markets Sell Off: Quick Thoughts

- One Day 20% Spikes in the VIX

- VIX Overreaction?

- One Day 30% (!) Spikes in the VIX

- VIX Up 54% to 17.15

- Birthday Party?

- Datawink Looks at the Past as Prologue for the VIX

- How to Think About the Day After: Executive Summary

…and added some trading ideas in another post prior to the next day’s open:

Note also that the blogging world was much smaller and more intimate in those days, so I was not surprised to see that David Merkel, Trading Goddess, Option Pundit, Jim Kingsland, Headline Charts, Lauriston Letter and other blogging luminaries of that era dropping by to add their thoughts in the comments section.

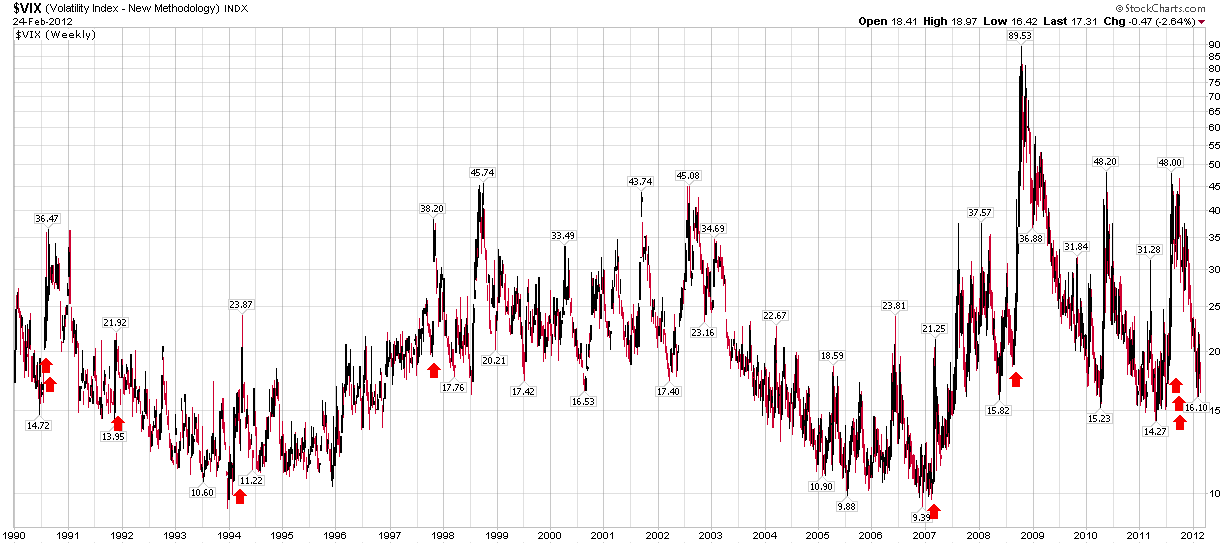

Of course this is where I typically get peppered with dozens of, “So what does a big one day spike in the VIX mean?” questions, so I have taken the liberty of highlighting the ten largest single day VIX spikes over the last 22 years (which includes reconstructed VIX calculations). As I see it, these one day spikes are typically instances in which a number of investors suddenly get their first glimpse of a dark gray swan and they panic, not knowing what is around the corner. For the most part, the panic turns out to be an overreaction. Of course, occasionally the big spike can look like a precursor of doom in retrospect, as was the case on September 29, 2008, when the VIX spiked 34.5%, just before stocks went into their plunge. When I see a big VIX spike, however, the first thing I do is get out my mean reversion trading kit.

Related posts:

- VIX Sets Some New Records, Suggesting Volatility Near Peak

- Highest Intraday VIX Readings

- Short-Term and Long-Term Implications of the 30% VIX Spike

- VIX Spike of 35% in Four Days Is Short-Term Buy Signal

- Lessons from the Post-2/27 VIX Price Action

- VIX Approaches Pre-2008 Record Highs

- VXO Chart from 1987-1988 and Explanation of VIX vs. VXO

- Volatility History Lesson: 1987

- Chart of the Week: VXV and Systemic Failure

- Forces Acting on the VIX

- A Conceptual Framework for Volatility Events

[source(s): StockCharts.com]

Disclosure(s): long FXI at time of writing