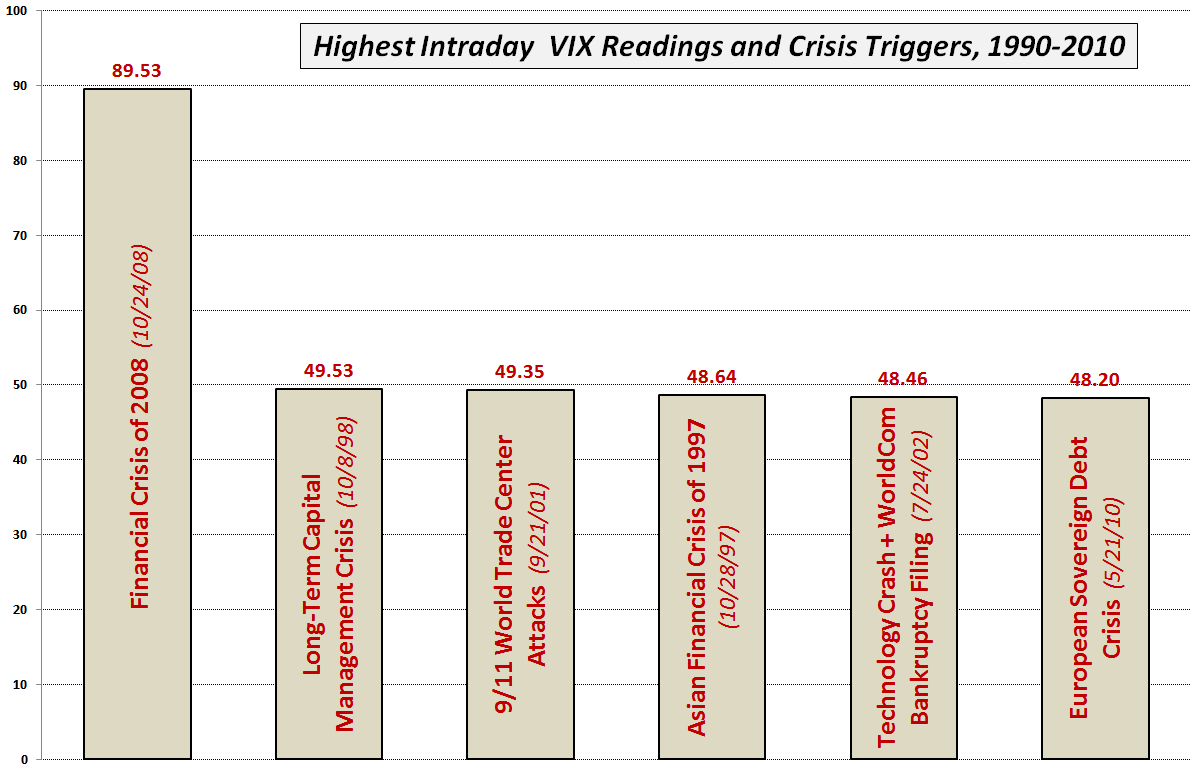

Highest Intraday VIX Readings

With stocks suffering a minor meltdown as I type this (DJIA 9997), I thought I might use the ongoing European sovereign debt crisis and recent May 21st VIX spike to 48.20 to put the recent VIX spike in the context of the all-time highest intraday VIX readings.

The graphic below captures the six crises which have resulted in VIX spikes above the 40.00 level since 1990. Notably, the 2008 financial crisis stands well above the crowed with an intraday high of 89.53. The other five crises have all seen intraday VIX spikes that have topped out in the 48-50 range, with last month’s spike to 48.20 making the European sovereign debt crisis the 6th highest threat – at least as far as an implied volatility proxy is concerned – in the past 20 years.

If one were to use reconstructed data going back to 1987, the best estimate is that the VIX (actually the VXO) would have hit about 170.

For more on related subjects, readers are encouraged to check out:

- VIX Approaches Pre-2008 Record Highs

- VXO Chart from 1987-1988 and Explanation of VIX vs. VXO

- Volatility History Lesson: 1987

- Chart of the Week: VXV and Systemic Failure

- Forces Acting on the VIX

Disclosure(s): short VIX at time of writing