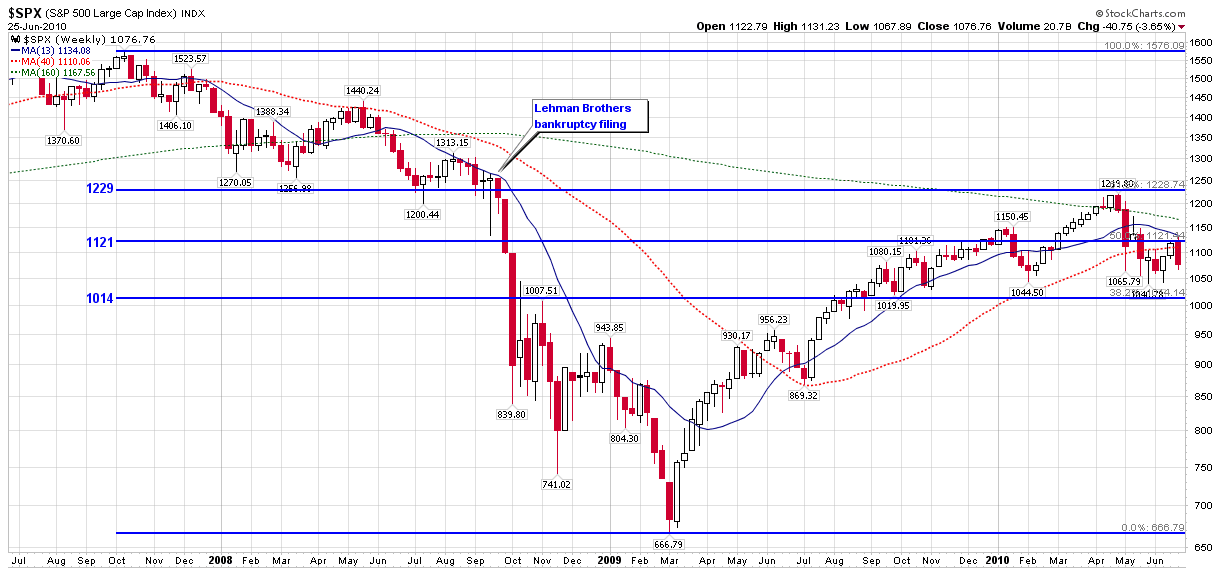

Chart of the Week: The Weekly SPX and Fibonaccis

This week’s chart of the week is simple and straightforward: weekly bars of the S&P 500 index.

In the chart below, I have added Fibonacci retracement levels to demonstrate that the rally off of the March 2009 lows has been stuck in a post-Lehman Fibonacci retracement zone (i.e., between the 38.2% and 61.8% retracement levels) for the past ten months.

The chart is essentially an updated version of a chart I showed on April 13 in Technical Resistance Looms in the S&P 500 Index. At the time I said, “This seems like a good time to play the Fibonacci retracement card and suggest that significant technical resistance looms for the SPX, particularly in the area of 1225 and above.” Now some eleven weeks later, Fibonacci levels are suggesting that we have a good chance of seeing range-bound trading in the area of SPX 1014-1229.

Of course, in order to define a trading range, stocks are going to have to do a more convincing job of establishing downside support. For the moment, at least, it is the bottom of this (potential) trading range that looks a little shaky.

For more on related subjects, readers are encouraged to check out:

- The Elusive Trading Range

- Sideways Markets, Covered Calls and the RUT

- One Approach for Volatile Sideways Markets

- Technical Resistance Looms in the S&P 500 Index

- Open Thread: Do Fibonacci Retracements Work?

[source: StockCharts.com]

Disclosure(s): none