Yesterday’s Unusually Low ISEE Equity Number

Yesterday’s ISEE equities only closing value of 100 was sufficiently low that only once in the last year has there been a lower number.

Recall that the ISEE is a call to put ratio (or an inverted version of the more common put to call ratio) and that the equities only variant is probably the best way to tap into the options habits of the retail options trader.

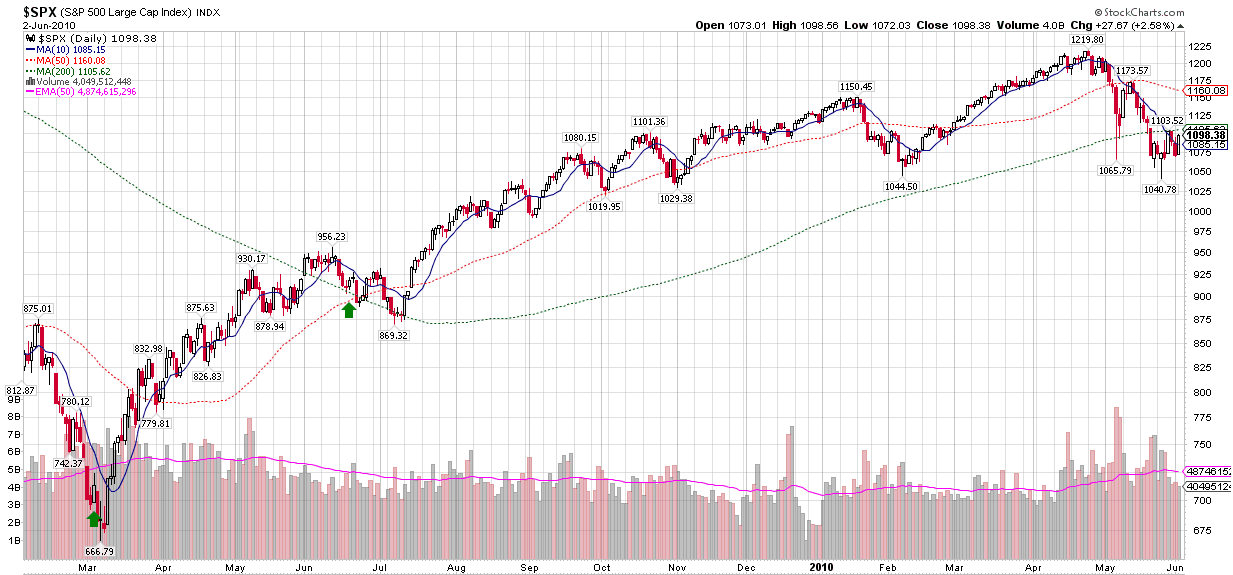

The chart below goes back to February 2009 to highlight with a green arrow the only two instances where the ISEE equities only index closed below 100. Note that both instance occurred just prior to an important bottom.

In the current context, the fact that the low ISEE equities only number appears just after what I think may be an important bottom raises two distinct possibilities:

- SPX 1040 may not turn out to be a bottom…OR

- SPX 1040 has a very good chance of holding as many investors are still firmly in the bear camp and have yet to come around to the long side

For more on the rationale behind the second alternative, which is the direction I am leaning in at the moment, Checking for Athiests (and some of the other posts linked below) may be of interest.

For more on related subjects, readers are encouraged to check out:

- Checking for Athiests

- Equity Put to Call Ratio Hits Ten Month Low

- Chart of the Week: Total Put to Call Ratio

- CBOE Equity Put to Call Ratio Poised to Print Warning

- A First Look at the ISEE

[source: StockCharts.com]

Disclosure(s): none