Recent TVIX Volume and VIX Futures Volume

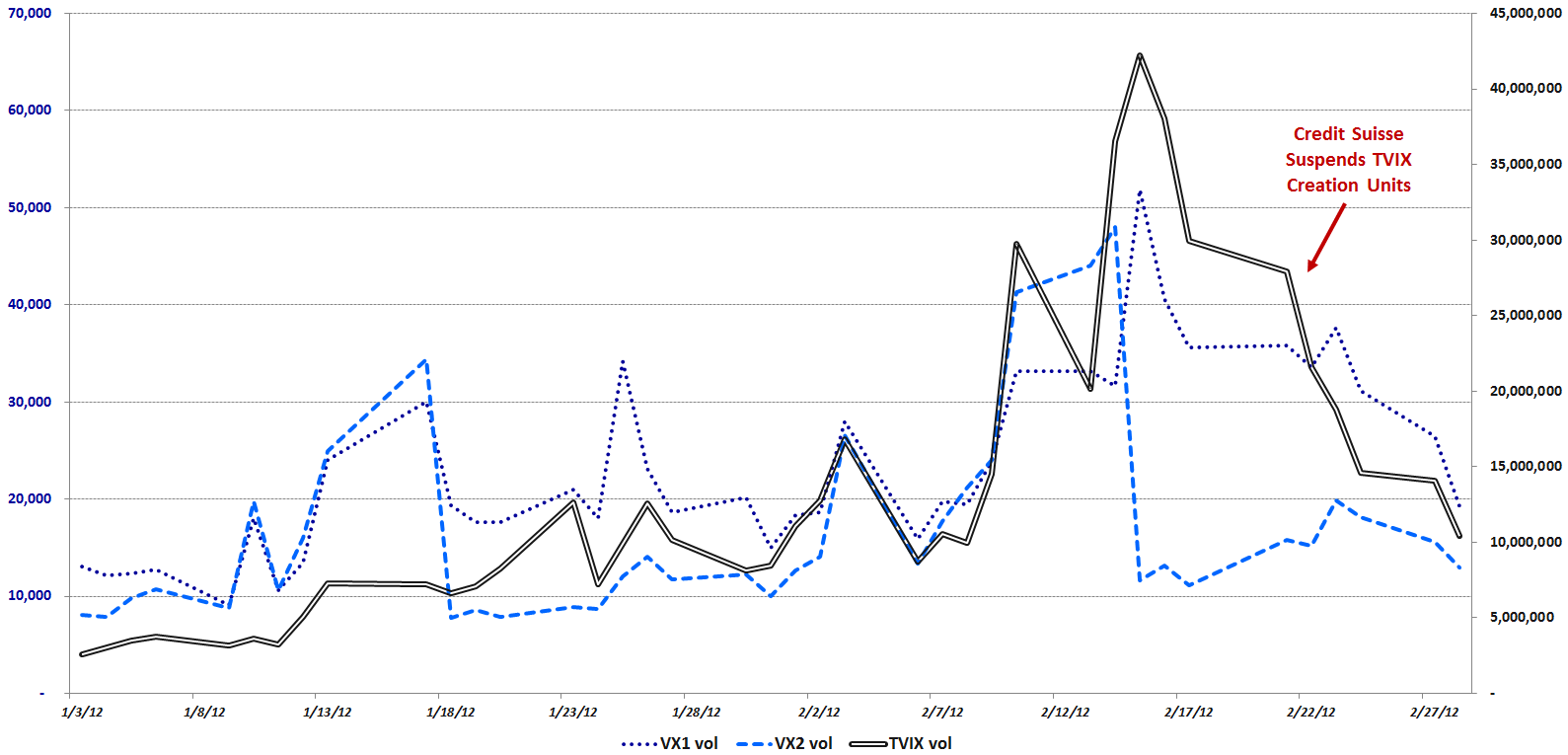

I managed to let a couple of days pass without mentioning the suddenly white-hot topic of the VelocityShares Daily 2x VIX Short-Term ETN (TVIX) only to discover at a Bloomberg Volatility Symposium in San Francisco last night that there appears to be an insatiable demand for more information on the subject. While the links below should present the lion’s share of the background and context about the key issues related to TVIX, today I am presenting some additional information related to the volume of TVIX for the first two months of 2012 and the corresponding volumes in the front month and second month VIX futures. The graphic below plots daily volume in TVIX (solid black line) on the right Y-axis and volume in the front two months of VIX futures, using settlement prices from the CBOE Futures Exchange (CFE), on the left Y-axis.

Once again I will let the graphic do most of the talking, but clearly when Credit Suisse (CS) announced a suspension of new creation units in TVIX after the close of the regular trading session on February 21, volume in both TVIX as well as the front month (dotted dark blue line) and second month (dashed medium blue line) dropped dramatically, almost in lockstep.

What it will take for the VIX futures and related markets to get to a point where Credit Suisse feels comfortable about reopening the creation units window for TVIX remains to be seen, but for now at least, the new normal in the VIX futures markets and to some extent for TVIX is beginning to resemble the old normal of two months ago.

Related posts:

- The Story of VIX ETPs Relative to their Intraday Indicative Values

- The Ups and Downs of the New Premium in TVIX

- Credit Suisse Suspends Creation Units in TVIX: What it Means

- Four Key Drivers of the Price of TVIX

- Will TVIX Go to Zero?

- TVIX Topples VXX as Highest Volume VIX ETP

- Who Is Trading TVIX?

- Volatility Becomes Unhinged on Friday

- VXX Options Calm After Second Highest Volume Day Ever

- TVIX Finally Getting Its Due As Day Trading Rocket Fuel

- TVIX Trades One Million Shares for First Time

- All About UVXY

- VIX and More and the 2011 Bespoke Roundtable

- VIX Exchange-Traded Products: The Year in Review, 2011

[source(s): CBOE Futures Exchange, Yahoo]

Disclosure(s): short TVIX at time of writing