CBOE Launches Options on VXX and VXZ

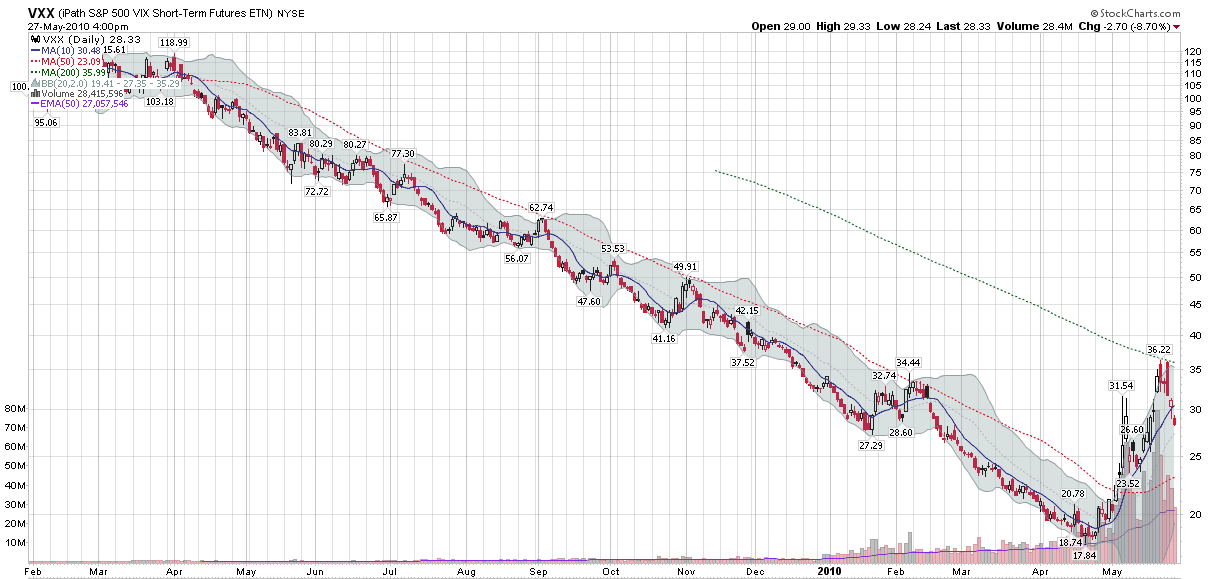

The iPath S&P 500 VIX Short-Term Futures ETN (VXX) has been one of the most closely followed topics on VIX and More, ever since the day the two VIX ETNs were launched, in January 2009. In the intervening 16 months, VXX has gone from an obscure niche product to a favorite of day traders, with volumes in excess of 20 million in each of the last 18 sessions. As a result, it is with great excitement that I note the CBOE has begun to offer options on VXX and VXZ today. (hat tip, Adam Warner)

I have discussed the calculation and performance quirks relative to VXX and its sibling, the iPath S&P 500 VIX Mid-Term Futures (5 month) ETN (VXZ) at considerable length in this space in the past and will not dive into that subjects again today. For those who are interested in exploring these issues in greater detail, the links below are a good place to start, as are the tags and hyperlinks for items such as VXX, term structure, VIX futures, contango and negative roll yield.

An even more through discussion of VXX calculations and performance can be found in The VIX ETNs: VXX and VXZ, in the March 2010 issue of Expiring Monthly.

I think it is safe to say that VXX options will open up a whole new world of volatility trading opportunities, whether considered separately or in conjunction with VIX options and other volatility products. I will definitely devote a good deal of time to this subject going forward.

For more on related subjects, readers are encouraged to check out:

- Chart of the Week: VXX Celebrates One Year of Futility

- Chart of the Week: VXX vs. VIX

- Why the VXX Is Not a Good Short-Term or Long-Term Play

- VXX Calculations, VIX Futures and Time Decay

- Disappointment Lurks as Volume Surges in VXX

- Lost in Translation: VXX and VXZ

[source: StockCharts.com]

Disclosure(s): short VXX at time of writing; I am one of the founders and owners of Expiring Monthly