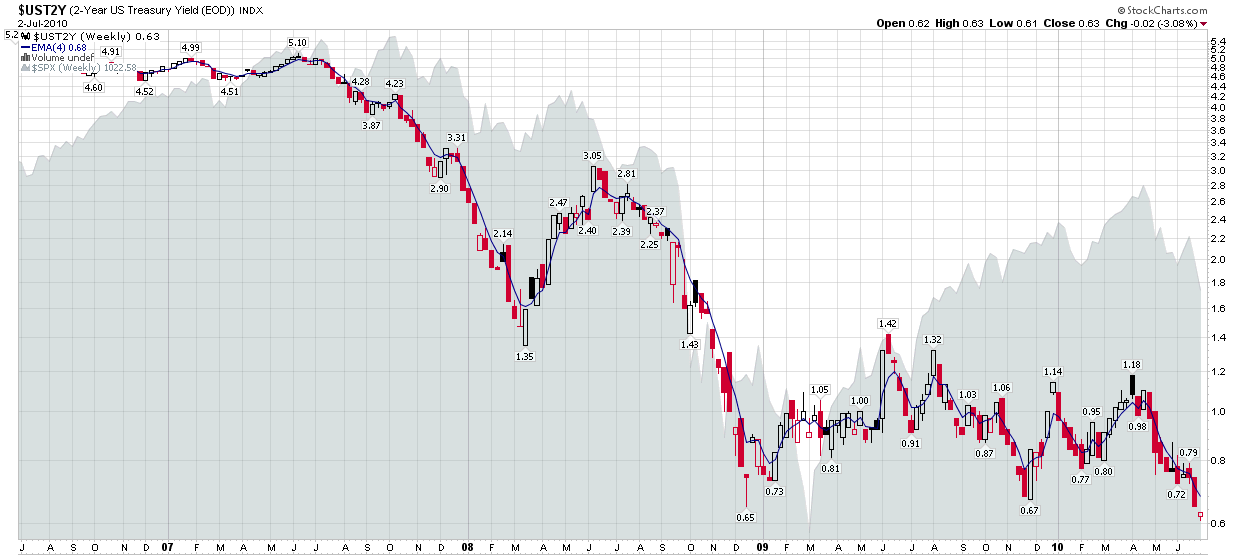

Chart of the Week: Record Low Yields for the 2-Year U.S. Treasury Note

As noted a week ago in Revisiting the Flight-to-Safety Trade, there are a handful of ways in which to keep an eye on the pulse of investor anxiety. These include U.S. Treasuries (including the various ETFs, such as TLT, IEF and SHV), the dollar (UUP), and gold (GLD). In terms of volatility, the preferred vehicles are the VIX, VIX futures and VXX.

For the last two weeks or so, stocks have been under considerable pressure, yet the action in the dollar, gold and volatility have been relatively mild and far short of panic. One has to look at U.S. Treasuries to see signs of extreme anxiety in the charts. This week’s chart of the week below shows weekly bars of the yield on the 2-Year U.S. Treasury Note going back four years. The yield on the 2-Year Note reflects an amalgamation of several factors, including the Fed’s easy money policy, potential deflationary speculative plays and demand which results from the flight-to-safety trade when investors are fearful of owning stocks, commodities and other investment vehicles. While it is difficult to disaggregate the component influences on the yield, it is safe to say that the record low yields seen last week include an important flight-to-safety component and are an excellent proxy for investor fear and anxiety.

For some of my thinking on why the VIX was unusually sluggish last week, see Impromptu VIX Talk, where Adam Warner (Daily Options Report) and I confirm that once again we have independently arrived at the same conclusions regarding volatility. [For those conspiracy theorists who wonder why we have never been seen in the same room, perhaps Adam's capture of our IM banter will quell thoughts of the ghost blogger typing away on the grassy knoll.]

For more on related subjects, readers are encouraged to check out:

- Chart of the Week: 10-Year Treasury Note Yield

- Revisiting the Flight-to-Safety Trade

- Yield Curve Looks Just Like May 2003

- The Battle for Bond ETF Supremacy

Disclosure(s): short VIX and VXX at time of writing