Chart of the Week: U.S. Retail Gasoline Prices

As more and more data points begin to suggest that the green shoots of months past are finally showing signs of developing, concerns about supply and demand in the energy space are starting to heat up again.

In the past week, the average retail price of gasoline in the United States shot up to $2.98 per gallon (and $3.29 per gallon in my home town of San Francisco, but who’s counting?) to a post-crisis high.

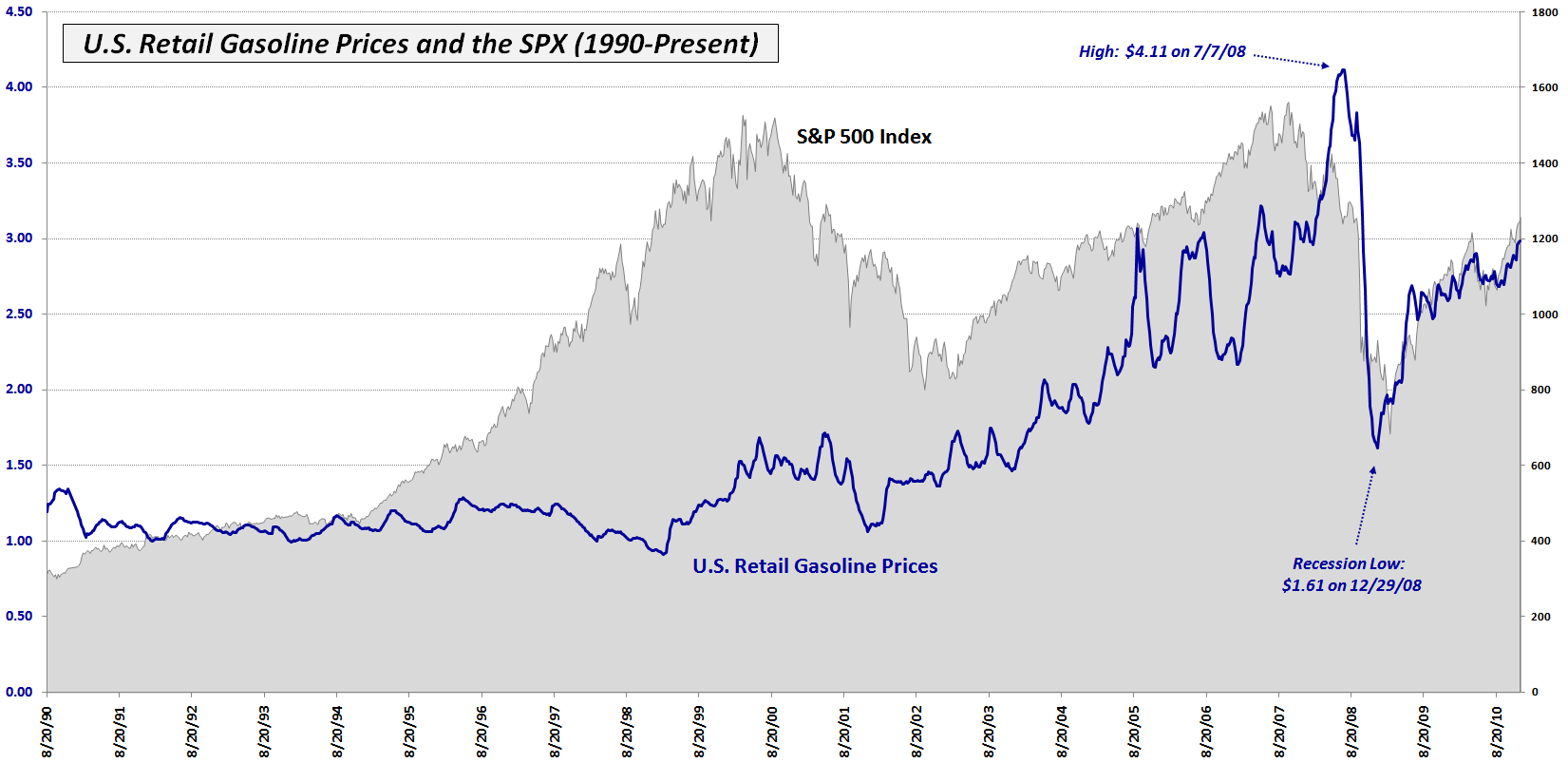

This week’s chart of the week shows 21 years of retail gasoline prices in the U.S. (blue line) plotted against a backdrop of the S&P 500 index (gray area chart.) Note that gasoline prices peaked in July 2008 at $4.11 per gallon and fell all the way to $1.61 per gallon by the end of the year, less than six months later.

Not surprisingly, gasoline prices peaked after stocks did and followed stocks down during the financial panic. Interestingly, gasoline actually bottomed about 2 ½ months before stocks and the two have been tracing a very similar pattern back up toward previous highs during the course of the past two years.

Going forward, continued increases in gasoline prices should begin to put pressure on consumer spending and slow down economic growth and the rebound in stocks. Whether this phenomenon begins to show up just on the other side of $3.00 per gallon or at much higher levels remains to be seen, but it is an important factor in the ability of consumers to repair their balance sheet, increase their spending, and power the 70% of the GDP that relies on consumer spending to drive growth.

Related posts:

- Turmoil in the Oil Patch

- It’s the Oil, Stupid

- Chart of the Week: The Resurgent Consumer and Holiday Shopping

- Chart of the Week: Retail Sales Recovering

- Chart of the Week: Crude Oil and Volatility

- Clean vs. Not-So-Clean Energy

- Energy ETFs and Katrina

- Chinese Solar Stocks on the Rise