Comparing SPLV and VQT

Based on some of the questions and comments that came out of Wednesday’s Three New Risk Control ETFs from Direxion, there appears to be a significant portion of the investment community that is uncertain about just how some ETPs are attempting to dampen volatility and control risk.

Today I am going to differentiate between three types of risk control approaches and compare two ETPs that have a little performance history. The approaches and an example ETPs are as follows:

- Using low beta stocks to minimize portfolio volatility (SPLV)

- Using a market timing mechanism that dynamically allocates between stocks and bonds according to measures of market volatility (VSPY)

- Using a market timing mechanism that dynamically allocates between stocks and VIX futures according to measures of market volatility (VQT)

On the other hand, the approaches employed by VSPY and VQT are hedges in the traditional sense in that they switch into asset classes (bonds and volatility) that are generally negatively correlated with stocks when measures of volatility such as implied volatility and historical volatility signal an environment that poses greater risk to long equity positions.

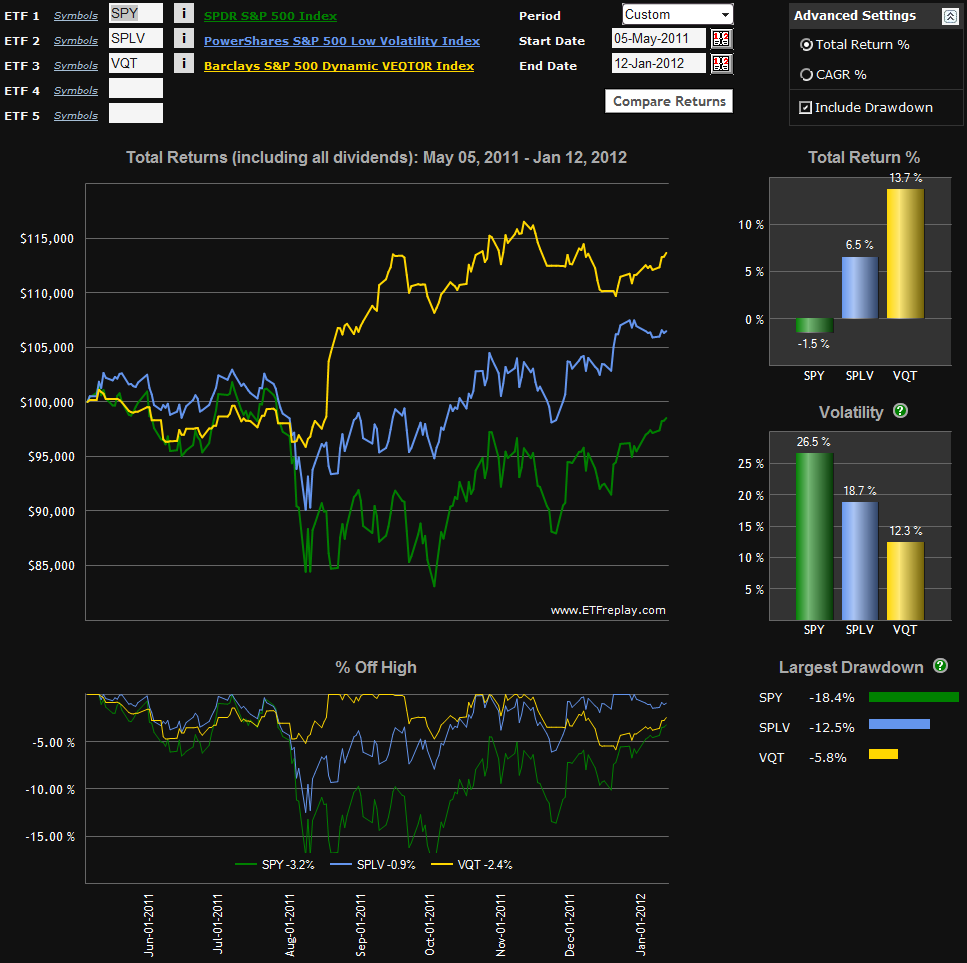

As VSPY was just launched this week, it is too early to talk about the performance of this approach, but the chart below captures the performance of both SPLV and VQT since the launch of the former on May 5, 2011.

Note that both SPLV and VQT are less volatile than SPY, had a lower drawdown, had a smaller peak to trough drawdown during the August-October selloff, and dramatically outperformed SPY during the period covered by the chart. Once VSPY establishes some meaningful historical data, I will return to this subject and offer a more detailed comparison of all three approaches to controlling risk.

For those interested in pursuing some of these subjects further, there is a good deal of information in the links below.

Related posts:

- Three New Risk Control ETFs from Direxion

- High and Low Volatility ETPs

- VIX Exchange-Traded Products: The Year in Review, 2011

- Slicing and Dicing All 31 Flavors of the VIX ETPs

- Direxion and S&P Bring Dynamic Volatility Hedging to ETFs with VEQTOR

- Barclays VEQTOR ETN (VQT) Begins Trading

- The Case for VQT

[source(s): ETFreplay.com]

Disclosure(s): none