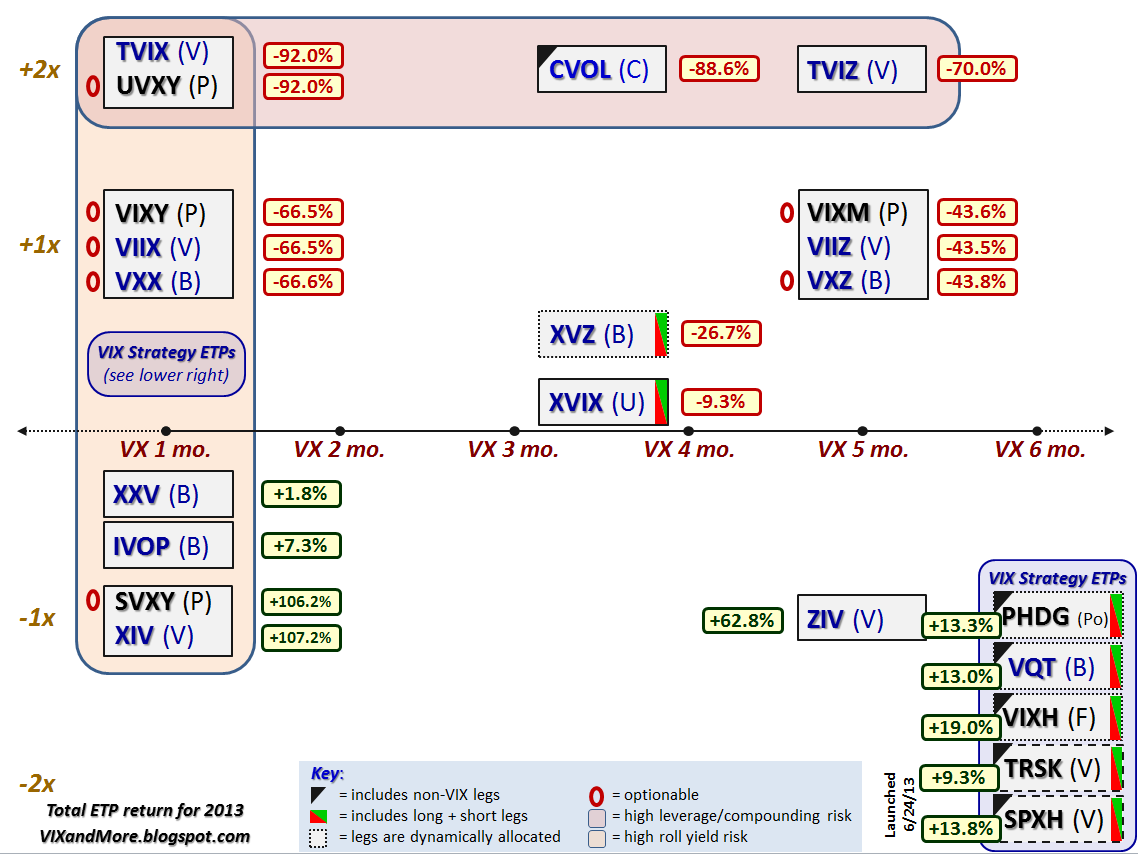

Performance of VIX ETPs in 2013

A number of readers have asked me to recap the performance of the VIX ETPs in 2013 according to the leverage/maturity grid I have been publishing for several years.

The graphic below should look familiar to long-term readers and measures the performance of all VIX and volatility ETPs for 2013, including dividends. (Two exceptions are TRSK and SPXH, which have data going back to June 24, 2013 and as such, the closing price on that date is treated as the opening price for 2013.) This time around I am going to refrain from most editorial comments, yet point out that the data bears a very strong resemblance to what I presented in VIX ETP Performance in 2012. It is also worth noting that just because there were similar numbers in 2012 and 2013, one should not expect these patterns to repeat on a regular basis. In Performance of VIX ETPs During the Recent Debt Ceiling Crisis, for instance, I present a very different set of data that students of volatility should also pay close attention to.

[source(s): CBOE, Yahoo, VIX and More]

For a more detailed discussion of the performance drivers of various VIX ETPs and for additional performance data and commentary, the links below should provide an excellent jumping off point.

Related posts:

- Performance of VIX ETPs During the Recent Debt Ceiling Crisis

- VIX ETP Performance in 2012

- Expanded Performance of Volatility-Hedged and Related ETPs

- Performance of Volatility-Hedged ETPs

- Performance of VIX ETP Hedges in Current Selloff

- Comparing SPLV and VQT

- Three New Risk Control ETFs from Direxion

- Will TVIX Go To Zero?

- Four Key Drivers of the Price of TVIX

- All About UVXY

- The Case for VQT

- Why VXX Is Not a Good Short-Term or Long-Term Play

- VXX Calculations, VIX Futures and Time Decay

- 2012 VIX Futures Term Structure as an Outlier

- Cheating with Partial Hedges

- How to Insure Your Stock Portfolio (Barron’s)

Disclosure(s): none