VXX, VXZ, XIV and ZIV During Eleven Months of a Sideways VIX

The VIX closed at 15.59 today, just 0.03 points lower than the close of 15.62 on April 26, 2011, some eleven months ago.

From a long-term perspective, not much has happened with the VIX, but for those who have ridden the volatility roller coaster up and down, the present time seems like an excellent opportunity to reflect on where the ride has taken us.

For those who have traded VIX exchange-traded products (ETP) during the last eleven months, the ride has been much different than that of the VIX itself, an issue I highlighted in VIX Exchange-Traded Products: The Year in Review, 2011, when I concluded, “While it is interesting that both the long and short volatility ETPs were unable to turn a profit for the year, there were stretches during 2011 that various VIX ETPs produced extraordinary gains.”

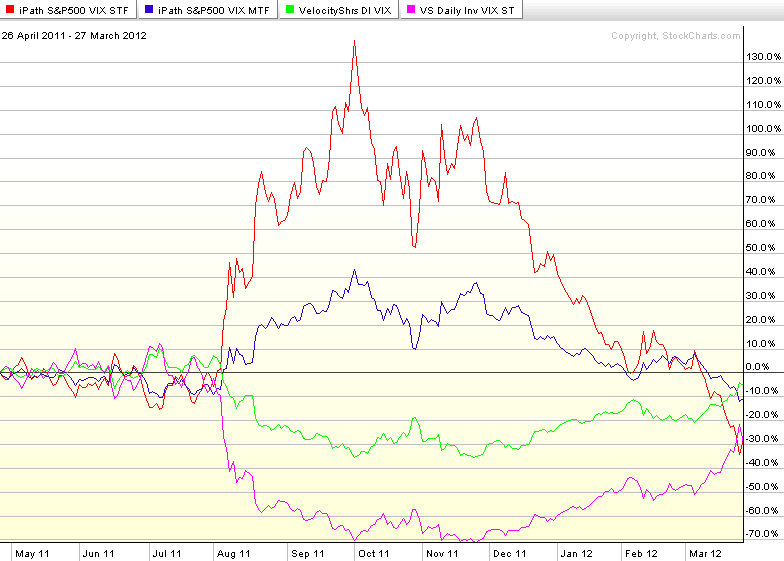

In the graphic below I have highlighted the performance of four popular VIX ETPs that are the most actively traded issues among the several that occupy a competitive space with a similar leverage factor and weighted average maturity (see Slicing and Dicing All 31 Flavors of the VIX ETPs for additional details):

- VXX – iPath S&P 500 VIX Short-Term Futures ETN (red line)

- VXZ – iPath S&P 500 VIX Mid-Term Futures ETN (blue line)

- ZIV – VelocityShares Daily Inverse VIX Medium-Term ETN (green line)

- XIV – VelocityShares Daily Inverse VIX Short-Term ETN (violet line)

Note that while the VIX traded sideways, all four VIX ETPs lost money, with the worst losses being incurred by VXX, which was down 28% during this period.

Not surprisingly, the two ETPs with the five-month target maturity (VXZ and ZIV) were considerably less volatile than their one-month target maturity counterparts.

There are a number of potential takeaways here, but perhaps the biggest of these is that VIX ETPs will struggle to outperform the VIX over longer-term time horizons. For these trades to be profitable, proper market timing is of the essence, as is the ability to take profits and/or cut losses when the trade starts to move sharply in the wrong direction.

Related posts:

- VIX Exchange-Traded Products: The Year in Review, 2011

- Slicing and Dicing All 31 Flavors of the VIX ETPs

- Now Sixteen Volatility ETPs, Four of Which Are Optionable

- Two More VIX ETNs Make it a Baker’s Dozen

- The Evolving VIX ETN Landscape

- Charting the Assets of Volatility-Based ETPs

[source(s): StockCharts.com]

Disclosure(s): long XIV and ZIV, short VXX and VXZ at time of writing