Continued Lackluster Economic Data vs. Expectations

While investors are focusing most of their attention on earnings reports, I am looking ahead to next week’s FOMC meeting, where the Fed will be more interested in economic data rather than corporate earnings.

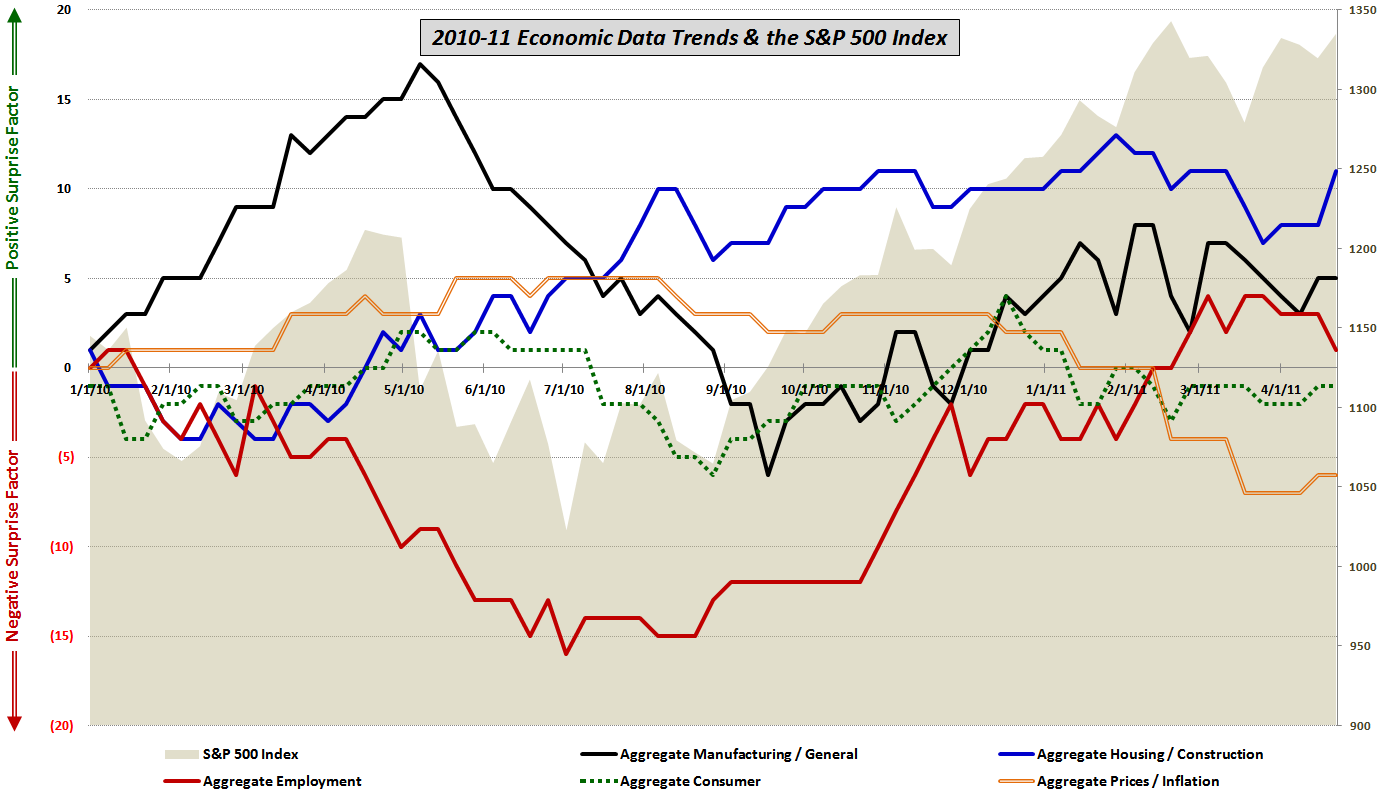

For this reason – and because of the absence of recent compelling trends in economic data – I have elected to publish an updated version of my chart of economic data vs. expectations, which has been a big hit in the past.

The chart shows that manufacturing and employment are no longer providing positive surprises relative to expectations, while data related to the consumer reflect consumer activity that is plodding at best. Housing and construction data, which had been a source of positive surprises in 2010, has shown some recent strength, but it is too early to consider this development any sort of new trend.

If I were the Fed I would continue to see a slow growth story, with 2011 bringing much less in the way of positive surprises than 2010 – at least in the first four months.

For more information on the components of this chart and the methodology, check out the links below to archived posts on the same subject.

Related posts:

- Chart of the Week: The Year in Economic Data (2010)

- Economic Data Frozen Until Next Thursday

- More Upticks in Economic Data vs. Expectations

- Economic Data Trends Improving

- Chart of the Week: Updated Economic Data Trends

- Economic Data Trends in Advance of Nonfarm Payrolls

- Trends in Economic Data Relative to Expectations

Disclosure(s): none