In spite of Warren Harding’s calls for a return to “normalcy” back in 1920, Americans – investors or otherwise – ended up with a decade that was anything but normal.

With the VIX a hair under the magic 30 barrier and Hurricane Dean taking aim at the Yucatan instead of the Texas refineries, we have almost surely seen a top in volatility. That being said, the VIX managed to close up on a weekly basis for the fifth time in the past six weeks, finishing the week at 29.99, up 6% (1.69) from the previous week. Is normalcy really just around the corner? My guess is that it is not too far away. The new high water mark in the VIX is now 37.50, which is the highest reading since October 2002, when the markets were just beginning to bottom, before turning up for the current five year bull run.

The VWSI continues in uncharted waters at -4 this week, but with the VIX already 25% off of the 37.50 spike top, there is finally evidence that the laws of gravity have been reinstated, at least temporarily. As the graphic below shows, the VWSI is now mildly bearish on the VIX, with mildly bullish implications for the overall markets. If you consider the strong possibility that the markets can no longer dwell on options expiration, a Fed with it’s head in the sand, or Hurricane Dean threatening the Texas-Louisiana oil infrastructure, then I suspect the coming week will more likely bring bullish surprises than bearish ones, especially given that it is a relatively slow week on the government data front.

I also suspect most pundits will wait until after Labor Day before declaring that it is safe to go back in the water, but I tend to think that excessive caution will likely result in missing out on the first big leg of a post-panic bounce.

(Note that in the above temperature gauge, the "bullish" and "bearish" labels apply to the VIX, not to the broader markets, which are usually negatively correlated with the VIX.)

Wine pairing: A VWSI of -4 comes along only a couple of times each year, so it is a good excuse to get off of the beaten varietal track. Also, it never hurts to diversify one’s portfolio internationally. With those thoughts in mind, I am recommending some tempranillo for a VWSI of -4. Tempranillo is the classic Spanish red grape that has long dominated the wine scene in Rioja and Ribera del Duero.

Americans looking to dive into tempranillo should recognize that the grape is not widely planted in the US and focus instead on Spain, which remains the center of world class tempranillo. For a good introduction to the grape and some affordable entry level recommendations, try Spain’s Early Ripener by Blake Gray in the San Francisco Chronicle. Considering that Spanish tempranillo is comparable in quality and stature to an Italian Super Tuscan, a French Bordeaux, or a American cabernet sauvignon, you should also be amenable to higher price points. Some excellent places to get ideas about premium tempranillos include the 2007 Shanghai Tempranillos al Mundo awards, the San Francisco Chronicle wine competition awards, and the tempranillo tasting notes on Cellar Tracker.

To read more about what is going on with this grape in Spain, I encourage you to check out Tempranillo, a blog about the Spanish wine industry.

Among the many indicators that have been giving contrarian bullish readings as of late is the ISEE, which narrowly missed making a new record low for its 20 day SMA earlier this week. Long time readers (can I already have any of these after only 8 months?) may recall that when it comes to the ISEE, I have a preference for using the 50 day SMA and for using absolute readings as well as movement away from well-defined tops and bottoms for the best trading signals.

Among the many indicators that have been giving contrarian bullish readings as of late is the ISEE, which narrowly missed making a new record low for its 20 day SMA earlier this week. Long time readers (can I already have any of these after only 8 months?) may recall that when it comes to the ISEE, I have a preference for using the 50 day SMA and for using absolute readings as well as movement away from well-defined tops and bottoms for the best trading signals.

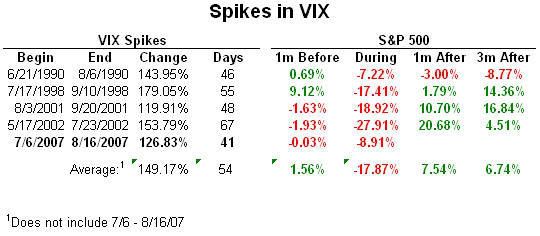

In my seemingly never ending quest to litter this space with obscure and occasionally relevant VIX trivia, I have today come across some numbers that I find particularly interesting.

In my seemingly never ending quest to litter this space with obscure and occasionally relevant VIX trivia, I have today come across some numbers that I find particularly interesting.

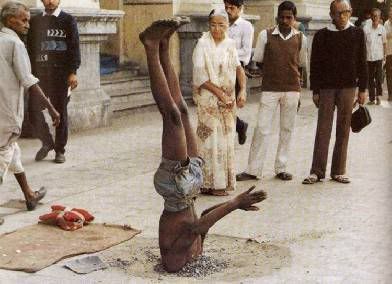

Sometimes just turning something upside down can help us to understand it.

Sometimes just turning something upside down can help us to understand it.

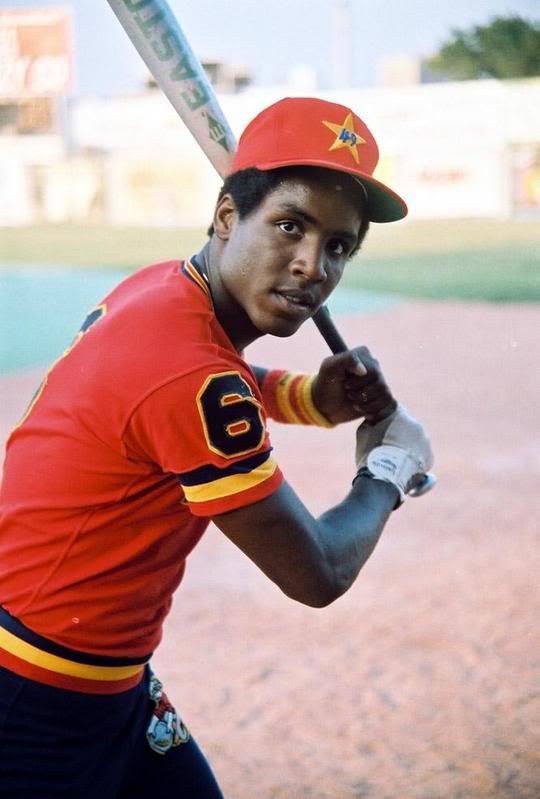

After a little mini-vacation of sorts, I landed back in San Francisco just in time to miss Barry Bonds hit #756.

After a little mini-vacation of sorts, I landed back in San Francisco just in time to miss Barry Bonds hit #756.

Since I write to a largely anonymous audience, I have no idea what sources of information my collective readership relies on to make informed decisions about the markets.

Since I write to a largely anonymous audience, I have no idea what sources of information my collective readership relies on to make informed decisions about the markets. I was fortunate enough to have been one of the first readers to stumble across

I was fortunate enough to have been one of the first readers to stumble across  Even with the VIX climbing over 25.00 for the first time since early 2003, I don’t believe that the big question should be how high it is going right now.

Even with the VIX climbing over 25.00 for the first time since early 2003, I don’t believe that the big question should be how high it is going right now.