Ticker Sense on VIX Spikes

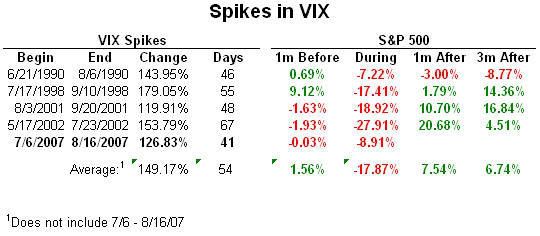

This morning Ticker Sense published an analysis of the four previous instances where the VIX has risen more than 100% in a three month period.

Among their findings is that the greater the drop in the SPX during this period, the greater the rebound in this index during the following month, as shown in the following chart, which is courtesy of Birninyi Associates / Ticker Sense:

An even more interesting finding – and one consistent with the capitulation theory – is that in each of the five instances (assuming last week’s VIX spike will turn out to be the top this time around), the largest move in the VIX came during the last 20% of the VIX run-up period.

2 comments:

I just discovered your site and it looks really intriguing and thus I'm sorry to make my first comment a critical one. Your reference to Birinyi & Assoc analysis does not point out the fact that there are only 5 data points. Nothing can be concluded with so tiny a sample.

I find that research outfit along with Bespoke and others to repeat this mistake over and over with analysis such as "out of the last X times this happened the market increased Y times" where X is a number smaller than 30.

I'll be an avid reader of this blog. Thanks.

Hi Frank,

Thanks for your kind words and comments about sample size. I agree that 30 is as good a heuristic as there is for doing a quick and dirty estimate of statistical significance.

When I first started this blog, I was pretty good about posting disclaimers about sample size, what was statistically significant, etc...but clearly I have gotten a little lax in this area.

For now, let's just say that where n < 30, readers should consider the entertainment/voyeuristic value to be greater than any informational value or statistical rigor.

Thanks for reading!

Post a Comment