Guest Columnist at The Striking Price for Barron’s: How to Insure Your Stock Portfolio

Today’s guest column at The Striking Price on behalf of Steven Sears at Barron’s marks the tenth time I have had the opportunity to write a column for Barron’s and this time around I even managed to suppress the impulse to write about the VIX and volatility – at least directly.

In How to Insure Your Stock Portfolio I drill down on an element of hedging I cited in one of my hall of fame posts, Cheating with Partial Hedges. Specifically, I talk about bear put spreads, which I like to think of as “gap hedges” due to the fact that they offer protection should the underlying fall in between two strikes.

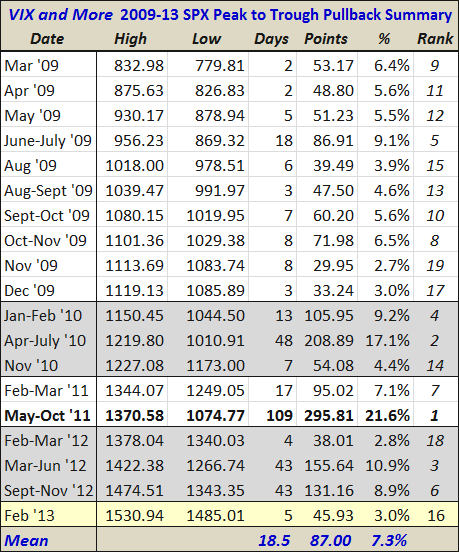

The Barron’s article talks about a specific SPY gap hedge strategy involving buying puts that are 5% out-of-the-money and offsetting some of the cost of the put protection (and capping the downside effectiveness) by selling puts that are 10% out-of-the-money. Done at a 1x1 ratio, this is a classic bear put spread that has the following effect on an SPY position:

[Graphic showing range of protection offered by 5% - 10% bear put spread or “gap hedge”]

What I didn’t have the space to discuss in the Barron’s article is the possibility of converting the 1x1 position into a ratio put spread by selling two 10% OTM puts for every one 5% OTM put that is purchased. With SPY closing at 154.14 today, the strike closest to a 5% pullback is 146, where the July puts currently at 2.55. At the same time, the 10% OTM strike is 139 and the July 139 puts are 1.40. With these numbers, a 1x2 ratio spread can be initiated for a credit of 0.25 (2x1.40 – 2.55) and provide protection down to SPY 139 (9.8% below today’s close) essentially for free. The big caveat here is that there is no such thing a free portfolio protection. What happens here is that in moving from a 1x1 put spread to a 1x2 ratio spread, the position is transformed from a limited risk position to a unlimited risk position where investors are exposed to the possibility of large losses should SPY fall below 139 prior to the July 20th expiration. For this reason, put ratio spreads – or any options trade with unlimited risk – should be utilized only by advanced options traders. In contrast, the standard 1x1 put spread is an excellent trade for beginning and intermediate options traders to seek to master.

Related posts:

- Cheating with Partial Hedges

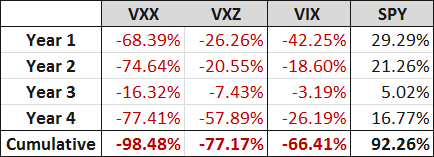

- Performance of Volatility-Hedged ETPs

- Why Not Point Hedges?

- Dynamic VIX ETPs as Long-Term Hedges

- Comparing SPLV and VQT

- Three New Risk Control ETFs from Direxion

- The Case for VQT

- The Year in Safe Havens

- The VIX as a Hedging Tool

A full list of my Barron’s contributions:

- How to Insure Your Stock Portfolio (April 18, 2013)

- The Case for Options Trading (January 2, 2013)

- Calm Down and Exploit Others’ Anxieties (November 14, 2012)

- How to Trade Options Around Volatile Events (July 10, 2012)

- Be Greedy While Others Are Fearful (May 3, 2012)

- Ways to Turn Volatility into an Asset Class (January 12, 2011)

- There’s Opportunity in Uncertainty (November 18, 2010)

- Will Market Volatility Return to Crisis Levels? (September 15, 2010)

- The Perils of Predicting Volatility (May 20, 2010)

- Take a Longer View on Volatility (July 2, 2009)

Disclosure(s): none