VXX and VXZ Celebrate Fourth Birthday

What better way to celebrate your birthday than by ripping off a huge gain. That’s what VXX must have been thinking today as it gained 6.2%, while it’s often overlooked sibling, VXZ, gained 2.2%.

Of course, the last four years have not been kind to these VIX exchange-traded products in the aggregate, but for selected periods, they have been remarkable performers. Just ask anyone who was short VXX when it spiked 198% during a period from July to October of 2011.

In spite of that impressive short-term performance, both VXX and VXZ have lost ground in each of the four years since their launch. To be fair, though, so did the VIX, if one measures each ‘performance year’ from January 30th.

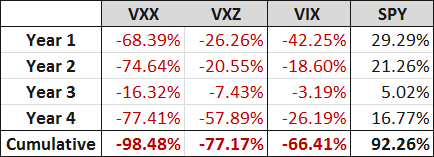

The table below shows the performance of VXX, VXZ, the VIX and SPY during each of those January 30th performance years. When one considers that in each of those yearly measurement periods the SPY advanced and the VIX declined, it is a little bit easier to swallow the performance of the two pioneering VIX ETPs.

[source(s): Yahoo, thinkorswim/TD Ameritrade, VIX and More]

In spite of some of the concerns expressed about the performance of VXX and VXZ in this space as early as the first half of 2009, VXX is still the #1 VIX ETP in terms of assets at $1.043 billion, while VXZ is in the #8 slot at $57 million.

To reiterate what I have maintained since their launch, VXX and VXZ are products that are suitable for short-term long volatility positions or for longer-term holding periods under certain market conditions. For those who are interested in more information, the links below should provide some excellent jumping off points.

All investors are encouraged to carefully study the prospectus of VXX and VXZ and more generally of all VIX and volatility-based exchange-traded products. I also strongly encourage potential investors in this space to spend some time learning the intricacies of VIX futures, contango, roll yield and other related subjects.

Related posts:

- VIX ETP Performance in 2012

- VIX Exchange-Traded Products: The Year in Review, 2011

- VXX, VXZ, XIV and ZIV During Eleven Months of a Sideways VIX

- A Monthly Comparison of VXX and VXZ

- XIV and ZIV Are Huge Success Stories Two Years After Launching

- 2012 VIX Futures Term Structure as an Outlier

- VXX Celebrates Third Birthday

- Chart of the Week: VXX Celebrates 2nd Birthday

- VXX Calculations, VIX Futures and Time Decay

- Why VXX Is Not a Good Short-Term or Long-Term Play

- VXX Monthly Performance

- Chart of the Week: VXX Celebrates One Year of Futility

- Chart of the Week: VXX vs. VIX

- Managing Risk with a Short VXX Position

- Charting the Assets of Volatility-Based ETPs

Disclosure(s): short VXX at time of writing