VIX ETP Returns for Q1 2012

Back in my consulting days, I convinced myself that there were rare instances when an ugly chart crammed full of data should take precedence over a clean and simple graphic that focused on the key takeaways. For my purposes at least, the graphic below, while unlikely to garner accolades from the likes of Information Aesthetics of Flowing Data, is one of those instances and suits my purposes perfectly. [After all, this blog is really just a place for me to archive my own idiosyncratic ideas and the two million interlopers are just a curious side effect, but I digress…]

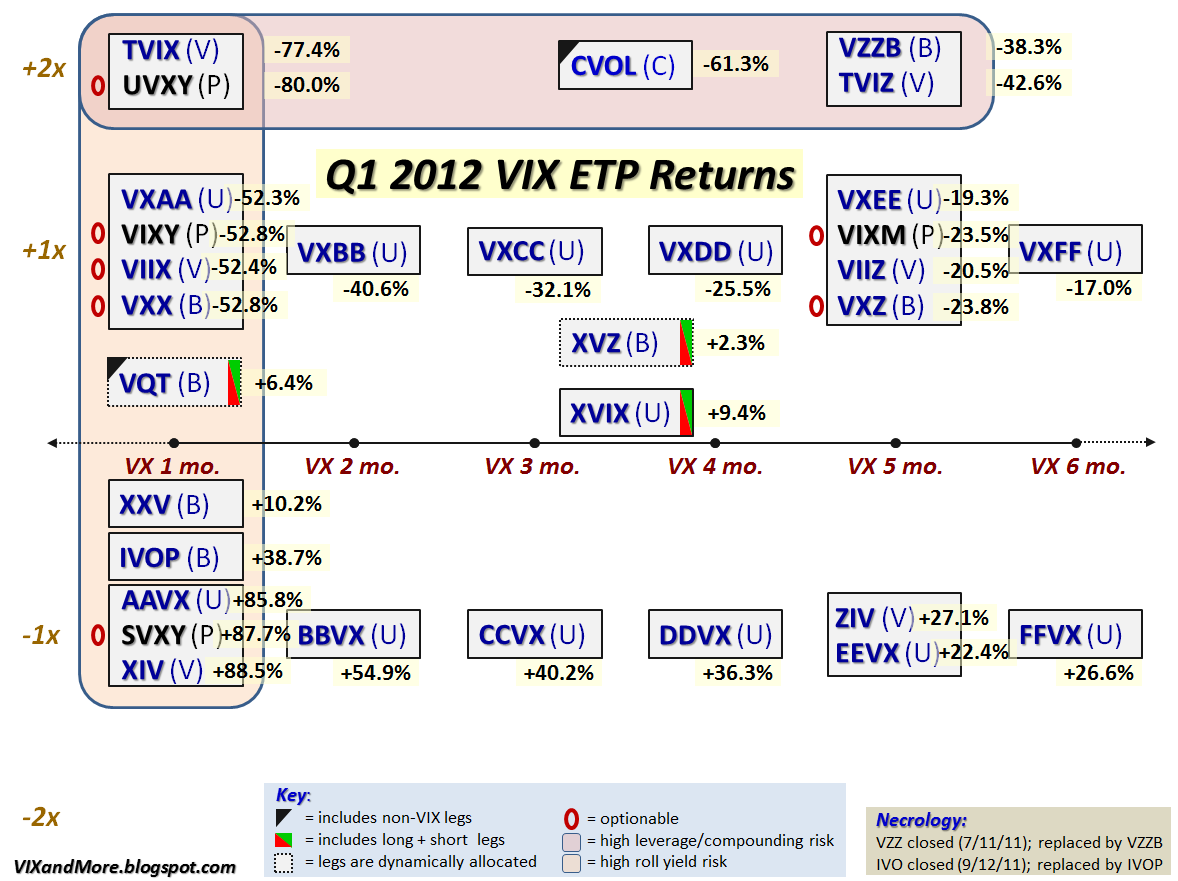

Getting back to the main point, the graphic below updates the VIX exchange-traded products (ETP) landscape (the only additions are two new red 0s to indicate that UVXY and SVXY are now optionable) and adds performance data for the first quarter of 2012.

Of course anyone who has checked in on this space periodically certainly has already realized that the first quarter saw record contango and negative roll yield across the full spectrum of the VIX futures term structure. As a result of this, the long volatility products had a horrendous three months, the inverse ETPs racked up huge gains and those products with dynamic allocations (VQT and XVZ) or offsetting long and short volatility legs (XVIX) were able to manage small(er) gains.

Following the usual pattern, the products with the shortest target maturities were the most volatile, while those with longer target maturities saw much less movement.

Also notice the symmetry of the return structure. For all the long products that were getting whacked (TVIX, UVXY, VXX, TVIZ, etc.) there were corresponding inverse products (XIV, SVXY, ZIV, etc.) that were racking up larger gains than the losses suffered by their long volatility counterparts.

Last but not least, perhaps the distribution of the returns will help to explain why I have organized my previous VIX ETP ‘field guides’ in this fashion.

This graphic should implicitly raise a bunch of issues and the links below are good jumping off points for further exploration regarding a number of those issues.

For the time being I will leave additional analysis to those in the comments section.

Related posts:

- VIX Exchange-Traded Products: The Year in Review, 2011

- VXX, VXZ, XIV and ZIV During Eleven Months of a Sideways VIX

- A Monthly Comparison of VXX and VXZ

- Options on UVXY and SVXY Open Up New VIX ETP Trading Approaches

- Dynamic VIX ETPs as Long-Term Hedges

- ETRACS Volatility ETPs

- Four Key Drivers of the Price of TVIX

- Will TVIX Go to Zero?

Disclosure(s): long XIV, ZIV, BBVX and XVZ; short TVIX, UXY and VXX at time of writing