VIX Premium to SPX Historical Volatility at Record High in Q1

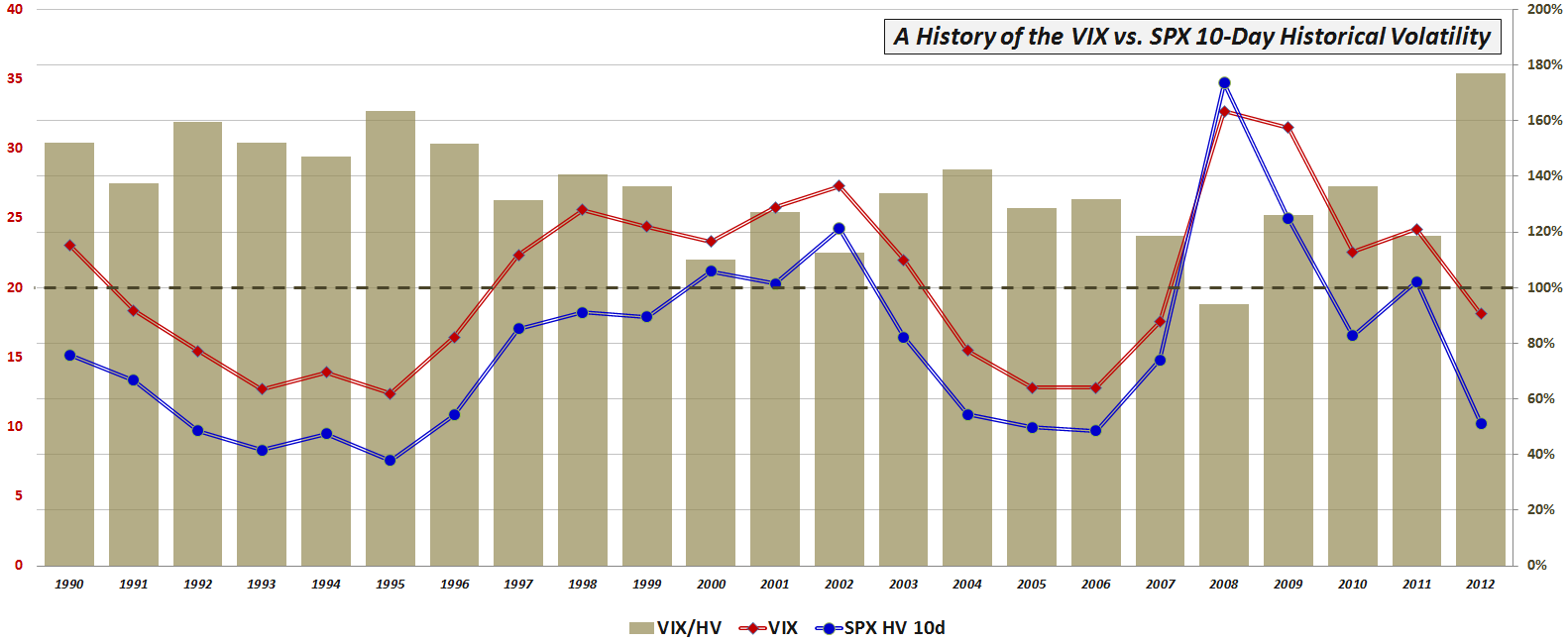

Back in September 2010, in VIX and Historical Volatility Settling Back into Normal Range, I presented an earlier version of the chart below to explain that in spite of the protestations of the time, the relationship between the VIX and historical volatility (a.k.a. realized volatility) was actually right in line with historical norms.

The same claim cannot be made for 2012.

In fact, as low as the VIX appears to many, for the first three months of 2012 the VIX has been tracking at 177% of the 10-day historical volatility of the S&P 500 index. This ratio is well above the long-term average of 129% and also above the record for a single year – 162% in 1995 – which was back in the time when the premium of the VIX over realized volatility in the SPX (“volatility risk premium”) was routinely much higher than it has been in recent years.

Consider for a moment that from January 27 to March 7, 10-day historical volatility of the SPX never crossed above 10.00. Had the VIX volatility risk premium been at the typical historical level of 129%, the VIX would have been below 13.00 for this entire period. Of course, the VIX never traded below 13.00 during this six-week period. Instead, investors were unwilling to accept a VIX this low (i.e., drop prices in SPX options) in spite of low realized volatility, which is part of the reason (perhaps along with disaster imprinting and related issues) why the volatility risk premium was at a record high during the first quarter.

Going forward, one can reasonably expect that either realized volatility will increase or the VIX will continue to fall so that the volatility risk premium approaches historical norms – and more likely that the future will combine elements of both scenarios.

Now that I have opened another Pandora’s box here, expect more to follow vis-à-vis the volatility risk premium.

Related posts:

- S&P 500 Index 20-Day Historical Volatility Hits 39-Year Low

- VIX and Historical Volatility Settling Back into Normal Range

- The Gap Between the VIX and Realized Volatility

- Will Market Volatility Return to Crisis Levels? (Barron’s)

- Chart of the Week: No More Free Lunch for Volatility Sellers?

- The Gap Between the VIX and Realized Volatility

- Historical Volatility Continues to Plummet

- What Is Historical Volatility?

- Rule of 16 and VIX of 40

- Availability Bias and Disaster Imprinting

- VIX Data to Support Availability Bias and Disaster Imprinting Hypothesis

- Calculating Centered and Non-Centered Historical Volatility

- Thinking About Volatility (First in a Series)

[source(s): CBOE, Yahoo]

Disclosure(s): none