Performance of VIX ETPs During Current Pullback

Of all the issues discussed in this space, undoubtedly the one that captures the imagination of most readers is the subject of VIX-based exchange-traded products. I get more questions about the construction of these products, how they respond to the VIX futures term structure, what factors influence performance, etc.

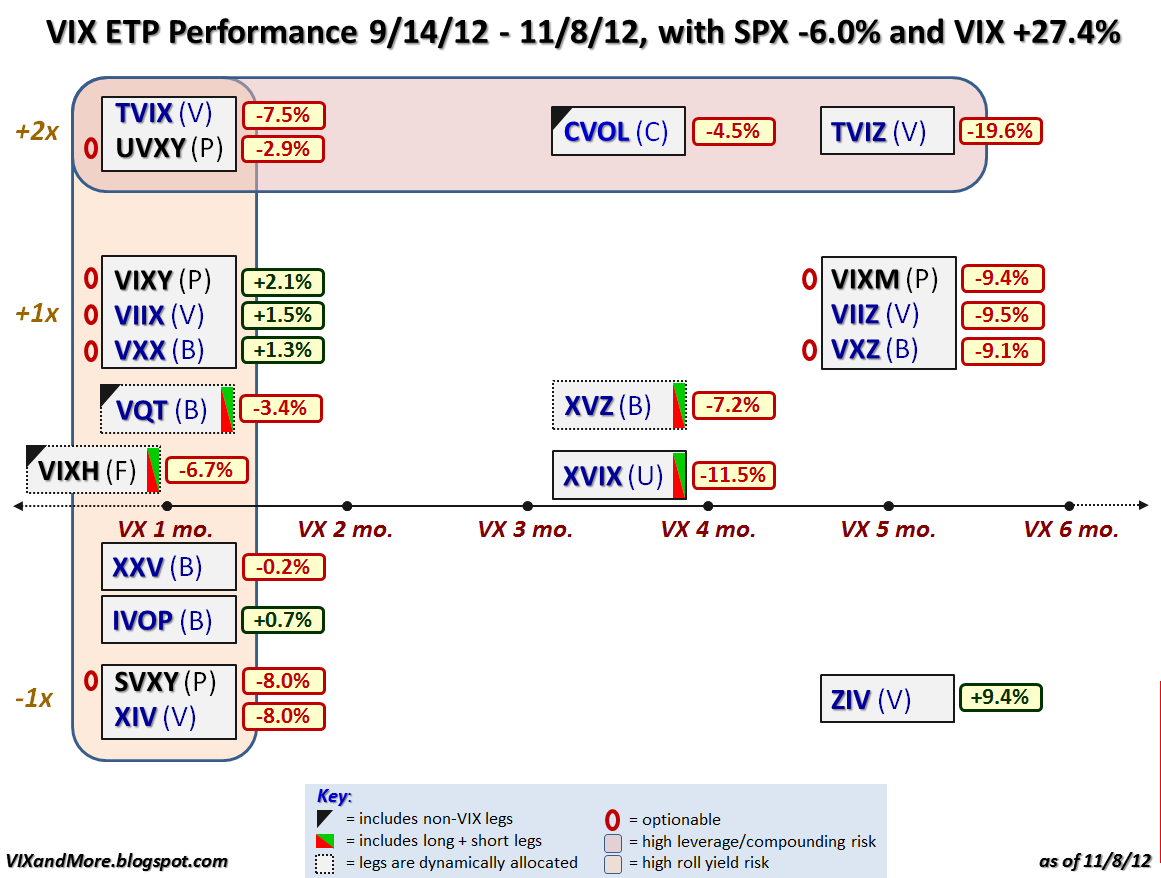

For these reasons I thought it might be instructive to update my VIX ETP landscape chart and include performance data from the September 14th market closing high of SPX 1465 to today’s close of SPX 1377. During that period, the SPX declined 6.0% on a close-to-close basis, while the VIX jumped 27.4% during the same period.

So how did the VIX ETPs fare while the market was selling off?

In examining the graphic below, the first thing you probably notice is that only 5 of the 19 VIX ETPs were able to manage gains during the selloff. In fact the average (mean) VIX ETP performance was a disappointing -4.9%, while the median return was -6.7%. Even more interesting, the inverse volatility products actually outperformed their long volatility counterparts and had the top performer of all, the VelocityShares Daily Inverse VIX Medium-Term ETN (ZIV).

In addition to the static allocation long and short volatility ETPs, there are also three products that use rules-based formulas to dynamically allocate the amount and type of long volatility exposure: VQT, XVZ and VIXH. None of these three products was able to produce a profit during the selloff and the top performer among the group, VQT, managed a loss of 3.4%.

I previously superimposed performance data on this same VIX landscape graphic back on April 3rd in VIX ETP Returns for Q1 2012, following a 12.0% gain in the SPX during that quarter and a 33.8% drop in the VIX. Note that only two VIX ETPs managed to post gains during the bullish first quarter and the selloff of the past eight weeks: ZIV and IVOP. If anyone wonders why I never bother to mention IVOP, first off it has only traded on three days during the past month and second, it has a participation of only 0.13, which means essentially that the portfolio moves as if only 13% of the assets were invested in the underlying index and the balance remained in cash. As for ZIV, I have been all over this one, including a feature post, ZIV Undeservedly Neglected, back in January.

Now that VIXH has been added to the mix of VIX ETPs, I will endeavor to provide performance updates on some or all of the VIX ETP product space on a more frequent basis going forward.

In the meantime, for those who are in search of reasons why some of the VIX ETPs outperform their peers in various market regimes, the links below are an excellent place to begin your research.

Related posts:

- VIX ETP Returns for Q1 2012

- Performance of Volatility-Hedged ETPs

- Performance of VIX ETP Hedges in Current Selloff

- Dynamic VIX ETPs as Long-Term Hedges

- ZIV Undeservedly Neglected

- VIX Exchange-Traded Products: The Year in Review, 2011

- VXX, VXZ, XIV and ZIV During Eleven Months of a Sideways VIX

- A Monthly Comparison of VXX and VXZ

- Options on UVXY and SVXY Open Up New VIX ETP Trading Approaches

- Comparing SPLV and VQT

- Three New Risk Control ETFs from Direxion

- The Case for VQT

- The Year in Safe Havens

- The VIX as a Hedging Tool

- Four Key Drivers of the Price of TVIX

[source(s): Yahoo]

Disclosure(s): long ZIV and XVZ at time of writing