Fiscal Cliff Worries Grow As Election Nears

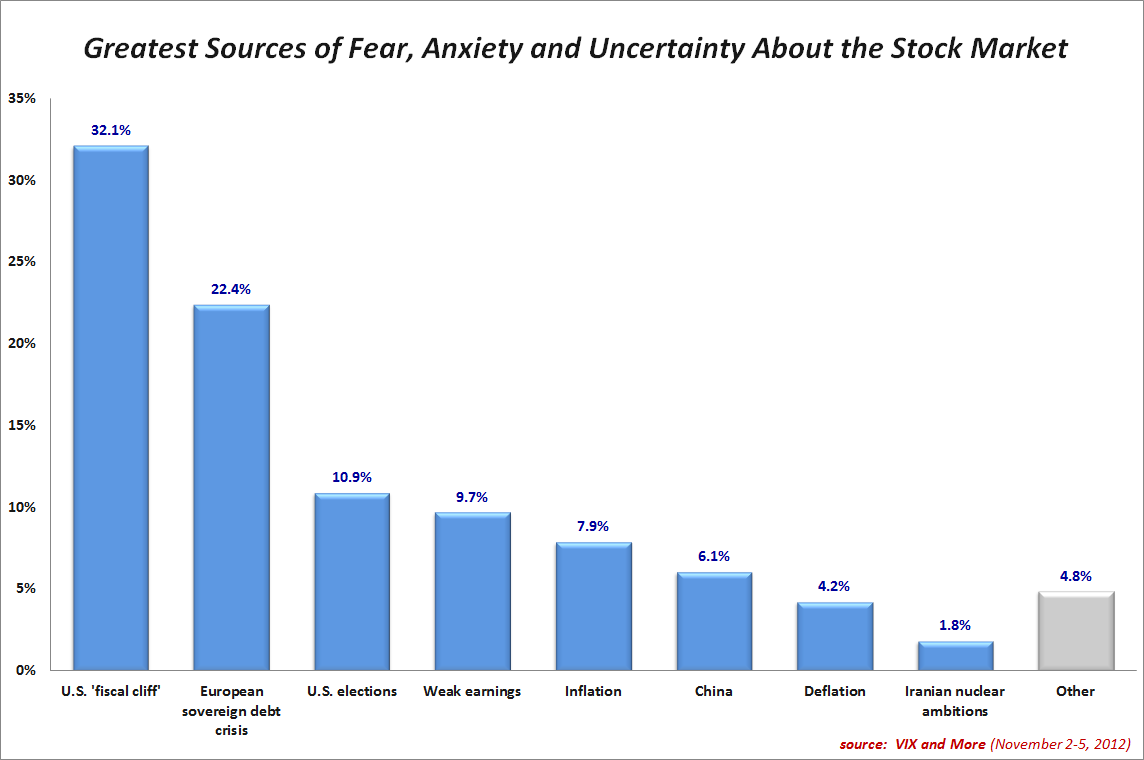

Anxiety over the outcome of the U.S. fiscal cliff topped the list of investor fears about the stock market for the third week in a row, outpolling the European sovereign debt crisis, which finished a distant second, and U.S. elections, which edged out weak earnings for third place.

With 65% of responses coming from U.S. voters, the poll results were once again skewed toward an Americentric perspective. Three weeks into this poll, it appears as if geographical and temporal proximity are having a strong effect on respondents. For third week in a row, U.S., respondents were much more concerned about events in their own country. For example, the fiscal cliff outpolled the European sovereign debt crisis by 14.8% in the U.S., while non-U.S. respondents had these two issues deadlocked in a tie for first place. Similarly, 13.9% of U.S. respondents cited U.S. elections as their top worry, while just 5.3% of non-U.S. respondents placed U.S. elections at the top of the list.

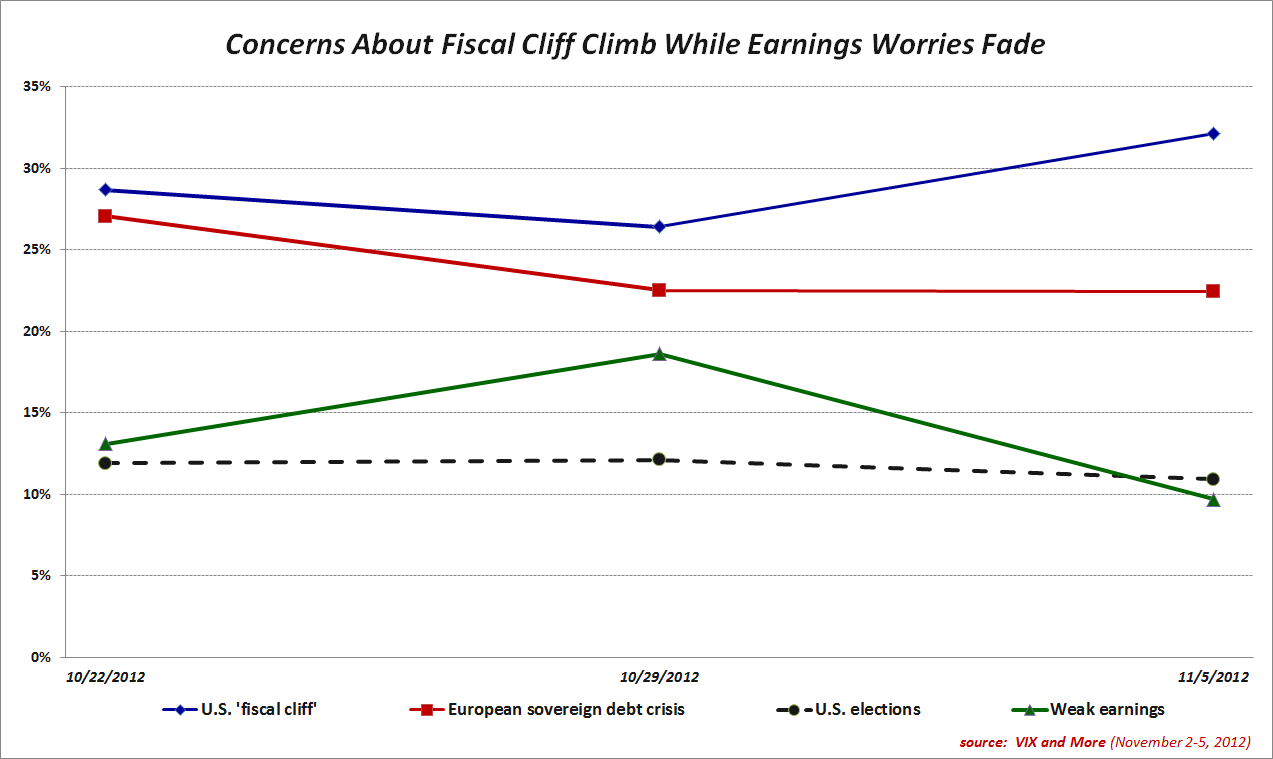

Not surprisingly, concerns about a weak earnings season fell sharply over the course of the past week, from 18.6% to 9.7%, as most of the critical earnings reports are already in the books and the potential for meaningful surprises has diminished substantially, as shown in the graphic below.

With most of the election uncertainty about to be resolved tomorrow, I anticipate that the fiscal cliff and the European sovereign debt crisis will once again separate from the pack in the next week. Whether this will place upward or downward pressure on the VIX remains to be seen.

Related posts:

- U.S Fiscal Cliff Fears Top VIX Fear Poll Again

- U.S. Fiscal Cliff Concerns Top Results in Inaugural VIX and More Fear Poll

- A Conceptual Framework for Volatility Events

- Forces Acting on the VIX

- Thinking About Volatility (First in a Series)

Disclosure(s): none