New and Noteworthy: VIXcentral.com

As a blog where the central focus is on the VIX and related subjects, I always try to keep an ear to the ground for new sources of information, analysis, data, tools, etc. for the VIX and volatility.

When a particularly interesting new site catches my attention, I try to highlight it in this space. Launched just a couple of weeks ago, VIXcentral.com is once such site. Eli, who runs VIX Central, is an active trader in the VIX products space. After writing a program that uses real-time VIX futures quotes from his broker to create a real-time VIX term structure graph, he asked himself, “Why not make the VIX term structure information available in graphic form over the web? Perhaps others would find this information useful also.” The result is VIX Central.

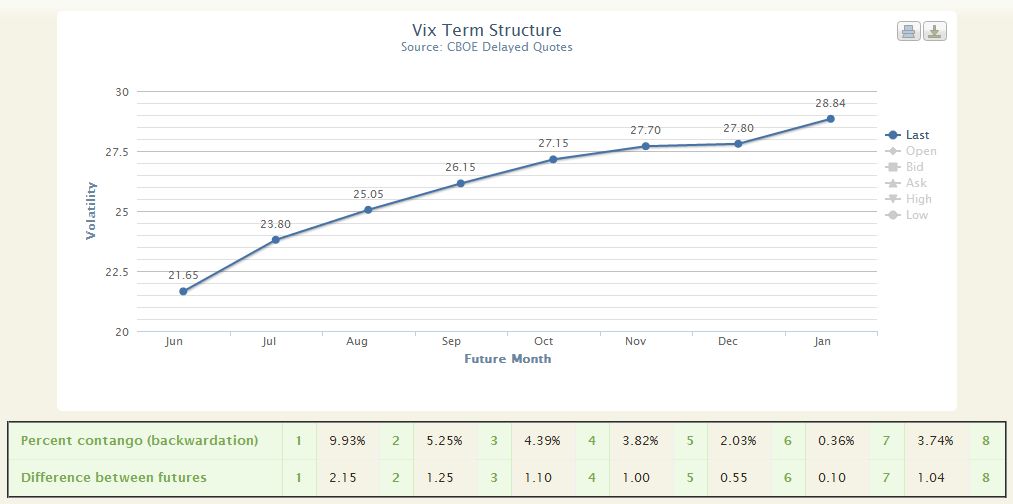

The centerpiece of VIX Central is the main page is a VIX futures term structure graph (see below), which also tabulates the absolute price difference between each of the VIX futures adjacent months, as well as the percentage contango or backwardation between these months.

Another tab worth investigating is the Historical Prices tab. Here you can call up the VIX futures terms structure for any date going back to March 2007. This can be done for individual dates or for as many as twenty dates on one chart. To see multiple days superimposed on the same chart, click on the Multiple Dates per Graph button and start with a date like September 30, 2008, then keep clicking on the Next Date button to see how the term structure evolves.

I am not sure where the site is going from here in terms of new features, but Eli indicates he is currently evaluating some similarity algorithms that can indicate which term structure periods in the past are similar to the current one.

The bottom line: VIX Central is informative and a valuable piece of information for anyone who trades the VIX product space. The historical term structure data is both fun and educational. Keep an eye on this site and if you have any feature requests regarding similarity algorithms or other functionality, this would probably be a good time to click on the Questions, Feedback and Suggestions link.

Enjoy!

Related posts:

- VIX Views

- Two Must Read Blogs for Volatility Aficionados

- Some Blogroll Highlights

- New Blog/Site Recommendation: Index Indicators

- Robert Engle’s Volatility Laboratory

- Livevol Pro: A World Class Suite of Volatility Tools

- Blogging Network a Better Buy Than BusinessWeek

- Trading Resources: Print and Electronic Magazines

[source(s): VIXcentral.com]

Disclosure(s): Livevol is an advertiser on VIX and More