Greek Elections and the Future of the Euro

While this week’s news cycle has been Spain, Spain, Italy and Spain so far (reminiscent of an old Monty Python skit, but I digress), it is easy to forget for a moment or so that Greece is holding another round of elections on Sunday.

As Greek law prohibits polling or publishing poll results in the 14 days leading up to an election, we do not know how voter sentiment about the bailout and remaining in the euro may be ebbing or flowing. Greek voters have certainly a great deal to think about, some of which may have been complicated by the positioning of Syriza’s leader, Alexis Tsipras, who insists that it is possible to repudiate the bailout agreement, start afresh with a new plan that is based on stimulating economic growth and job creation – yet never have to leave the euro zone in the process.

So just how will the Greek elections influence the future of the euro?

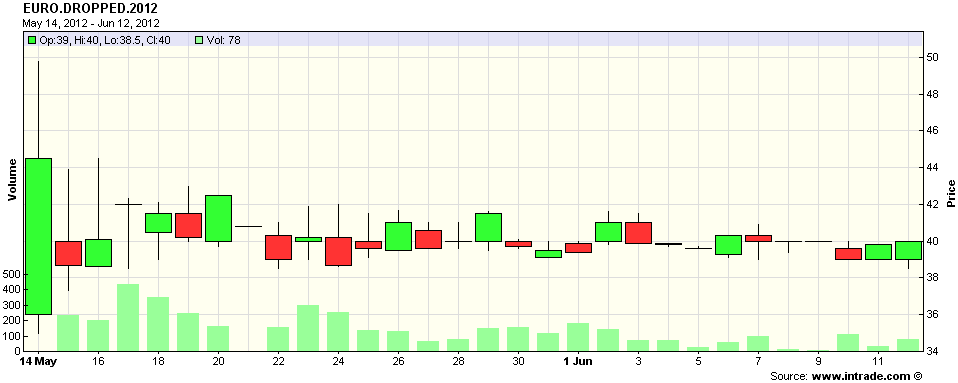

Without polls, the Intrade contract that specifies “Any country currently using the Euro to announce intention to drop it before midnight ET 31 Dec 2012” now becomes an even more valuable informational resource. The problem is that in spite of a fair amount of activity, the price of the contract has remained essentially unchanged for the last month, hugging the 40 level (see chart below), which means that participants continue believe that the chance of a Greek exit (I refuse to say ‘Grexit’) by the end of the year is about 40%.

By Monday we will have a much more information, but once again, the process of forming a coalition government may prove to be troublesome…or worse.

For those looking for hedges against some panic in the financial markets next week, keep in mind that VIX options do not expire this week, but next Wednesday, June 20th. As such, VIX calls may prove to be an appropriate hedge against at least short-term post-election anxiety. For those looking for volatility hedges on a week-to-week rather than monthly basis, it might be helpful to investigate VXX weekly options (A Favorite Trade: VXX Weeklys) as well. Last but not least, a reader favorite is a thought piece on the process of constructing hedges is Cheating with Partial Hedges.

Related posts:

- Handicapping the Chances of Greece Dropping the Euro

- The Hollande Discount

- A Favorite Trade: VXX Weeklys

- Cheating with Partial Hedges

- Expectations, Surprises and Fear in 2011

- Chart of the Week: European Stocks Holding Up Well

- Recent Performance Divergence in European ETFs

- Where and When Will the Euro Bottom?

- Greece, Spain and the Pulse of European Anxiety

- Are You Watching Greece?

- Intrade Prediction Markets as a Sentiment Indicator

[source(s): Intrade.com]

Disclosure(s): short VXX at time of writing