Weekly Options Gain Momentum

Up until a couple of weeks ago, it was almost impossible to find anyone who thought it was worthwhile to mention weekly options: options that have the same terms as standard monthly options, except that they expire on every Friday other than the third Friday of the month (which is when standard monthly options expire.)

For those who find the definition above a little too sparse, the CBOE has an excellent FAQ for weeklys; the Options Industry Council (OIC) also has a weekly options FAQ for those who wish to learn a little more about these products.

Some of my fellow bloggers have already taken up the cause of weekly options and have shared some of their initial thinking on the subject:

- Weekly Options for the Masses – SPX, QQQQ, IWM, DIA and Others (Six Figure Investing)

- Weekly Options Could Affect Stock Prices (Adam Warner, InvestorPlace)

- WeeklyOptionPalooza (Adam Warner, Daily Options Report)

- Weekly Options and Pinning Effects (Steve Place, Investing With Options)

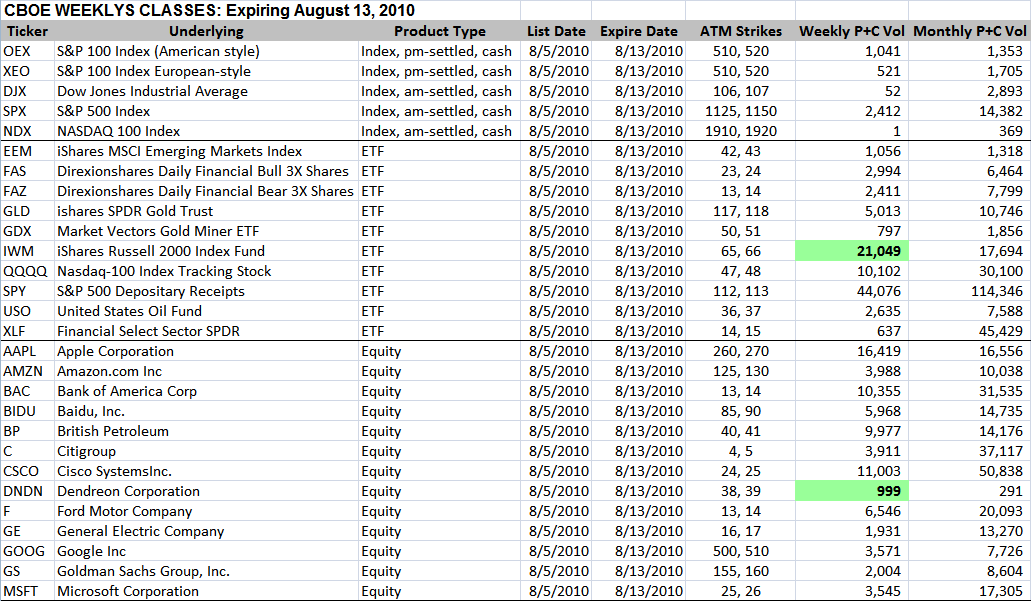

Before anyone gets too excited about new products, one of the first questions is invariably about liquidity and market depth. Rest assured, there is already substantial liquidity and market depth in the weekly options being offered. In the table below, I have calculated today’s volume in weekly options and standard options for the two at-the-money strikes for all the weeklys listed by the CBOE. Note that for the most part, the weekly options volumes are running at about one third to one half of the rate of the standard monthly options. In the case of IWM and DNDN, today’s weekly volume exceeded the volume in the monthly options.

For the record, I made my first weekly option trade last week and I was excited because it was a trade I never would have made unless it was near the end of an expiration cycle – a time frame many options traders avoid, but I like to embrace. Given the increasing popularity of weekly options and new end-of-cycle trading opportunities, I would recommend that anyone who has not already done so to spend some time with Jeff Augen’s excellent Trading Options at Expiration, where many of Jeff’s ideas can now be applied on a weekly basis.

I will have a lot to say about weeklys (blame the CBOE for the spelling choice) going forward. In the meantime, readers looking to learn more about these products should start with the CBOE Weekly Options splash page.

Disclosure(s): long IWM at time of writing; both the CBOE and Livevol are advertisers on VIX and More