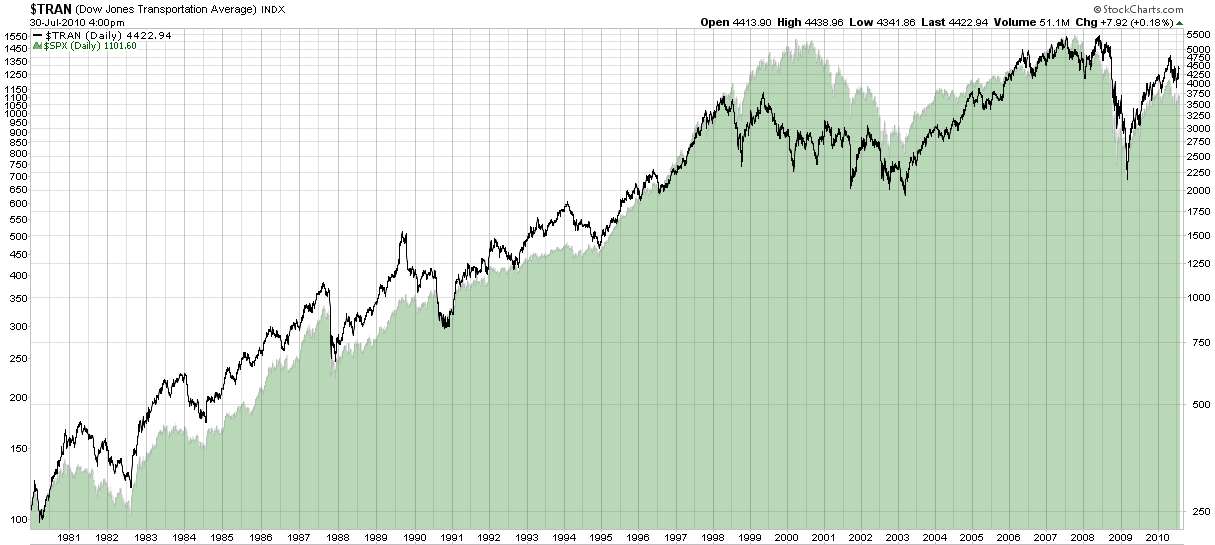

Chart of the Week: Transports Leading…

For this week’s chart of the week, I have elected to shine some light on the Dow Jones Transportation Average (DJTA), which is revered by Dow Theory adherents, yet often underappreciated by a larger group of investors.

Since the March 2009 bottom, high relative strength readings in the transports have tended to precede significant bull moves in the broader markets. Rather than spell out how the transports might be a leading market indicator, I have chosen to use the chart below to show the performance of the DJTA over the course of the last thirty years and encourage readers to dig deeper. In my experience, the transports are generally an excellent proxy for the health of broader economy. Given the way the markets have recently reacted to earnings from FedEx (FDX) and have done so similarly for UPS, Union Pacific (UNP), Ryder (R) and others in the past, it appears as if I have a fair amount of company.

For more on related subjects, readers are encouraged to check out:

- Breaking Down the Weakness in Transports

- Chart of the Week: Falling Transports

- The Shift from Roads to Rails

- Watch the Baltic Dry Index in 2009

Disclosure(s): none