Wheat and the Commodity ETF Space

Anyone with even a passing interest in commodities has no doubt taken notice that the worst drought in Russia in at least 50 years, coupled with climatological excesses around the globe which have created a substantial disruption in the supply of agricultural commodities, most notably in wheat.

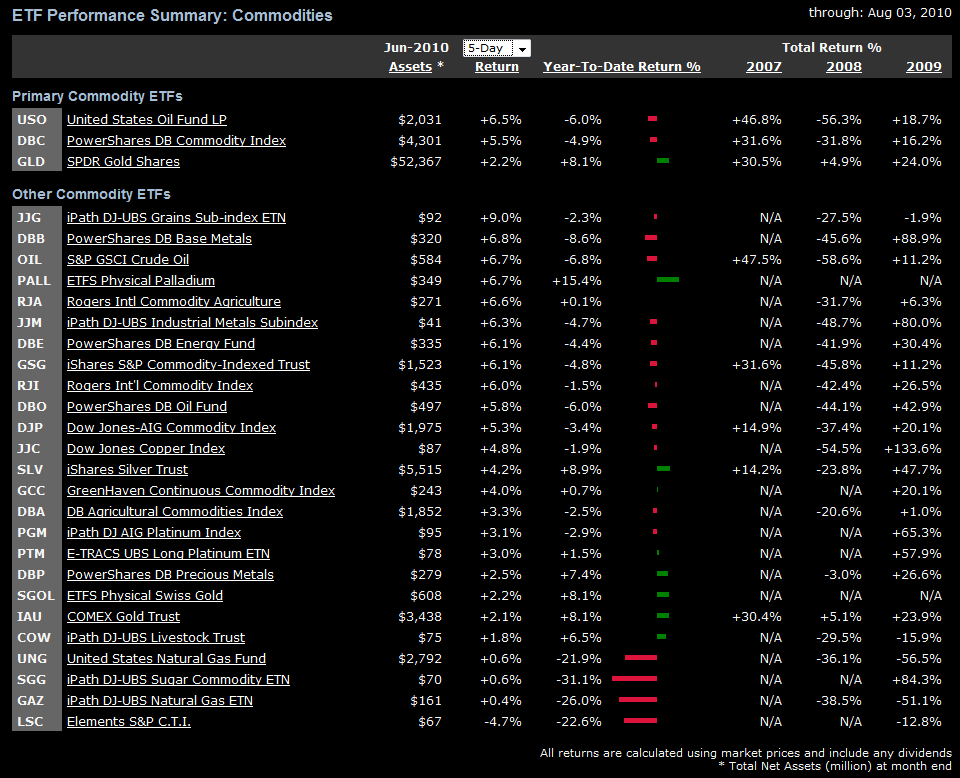

The graphic below from ETFreplay.com summarizes some of the impact on selected commodity ETFs and ETNs over the course of the past week. Note that JJG, the iPath Dow Jones-UBS Grains Total Return Sub-Index ETN, is up 9% in the past week and broader commodity and agricultural ETFs such as RJA and DBC have also been lifted significantly by the surge in agricultural futures prices.

In addition to JJG, investors looking for a grain-specific ETF/ETN may also wish to check out GRU, the ELEMENTS MLCX Grains Index Total Return ETN. As noted last Friday, investors can also take a long position in grains by shorting the ELEMENTS S&P Commodity Trends Indicator ETN (LSC), where 36.8% of the ETN is currently short grains.

For more on related subjects, readers are encouraged to check out:

- LSC Long-Short Commodities ETF Struggling Mightily

- Chart of the Week: Impact of Falling Euro on Stocks and Commodities

- Chart of the Week: Commodities and the Dollar

- Chart of the Week: Breaking Out Recent Commodities Moves

- CME to Use VIX Methodology for New Crude Oil, Corn, Soybean and Gold Volatility Indices

Disclosure(s): long JJF and short LSC at time of writing