Commercial Real Estate Sub-Sector Breakout

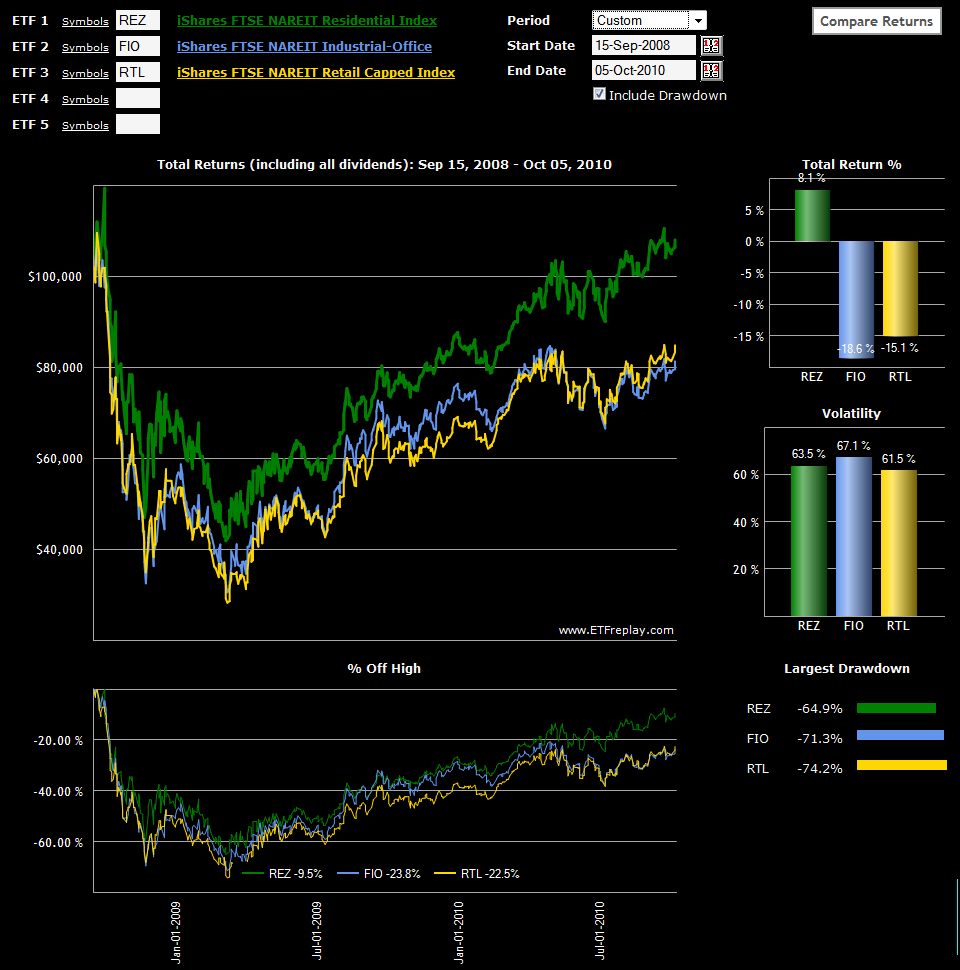

Back in April 2009 in Commercial Real Estate Sub-Sectors ETF to Watch, I highlighted three commercial real estate sub-sector REIT ETFs, discussed their composition and included a performance graph going back to the date of the Lehman Brothers bankruptcy, September 15, 2008. The three REIT ETFs are:

- FTSE NAREIT Retail Capped Index Fund (RTL) – emphasis on shopping centers (46%) and regional malls (43%)

- FTSE NAREIT Industrial/Office Capped Index Fund (FIO) – mostly office (66%), but some (21%) industrial

- FTSE NAREIT Residential Plus Capped Index Fund (REZ) – apartments (47%) dominate, but with a healthy dose (37%) of health care

Note that the residential real estate ETF, REZ, has rallied to where it is currently trading 8.1% above its pre-Lehman level and comfortably above the April 2010 high. On the other hand, the highly correlated industrial/office real estate ETF (FIO) and retail real estate ETF (RTL) are still both more than 15% below their pre-Lehman levels and are struggling to move above their April 2010 highs.

Real estate is a multi-dimensional beast and these three sub-sector ETFs can assist investors in understanding which parts of the real estate market are showing relative strength and which are demonstrating relative weakness.

Related posts:

- Updating the Commercial Real Estate Picture

- The Looming Commercial Real Estate Crisis

- Commercial Real Estate Blogs

- Three Commercial Real Estate Sub-Sector ETFs to Watch

- Moodys/REAL Commercial Property Price Index

- Commercial Real Estate Problems Piling Up

[source: ETFreplay.com]

Disclosure(s): none