The REZ Paradox

I had a brief exchange with Andrew Butter on Seeking Alpha that I thought might warrant a broader audience here.

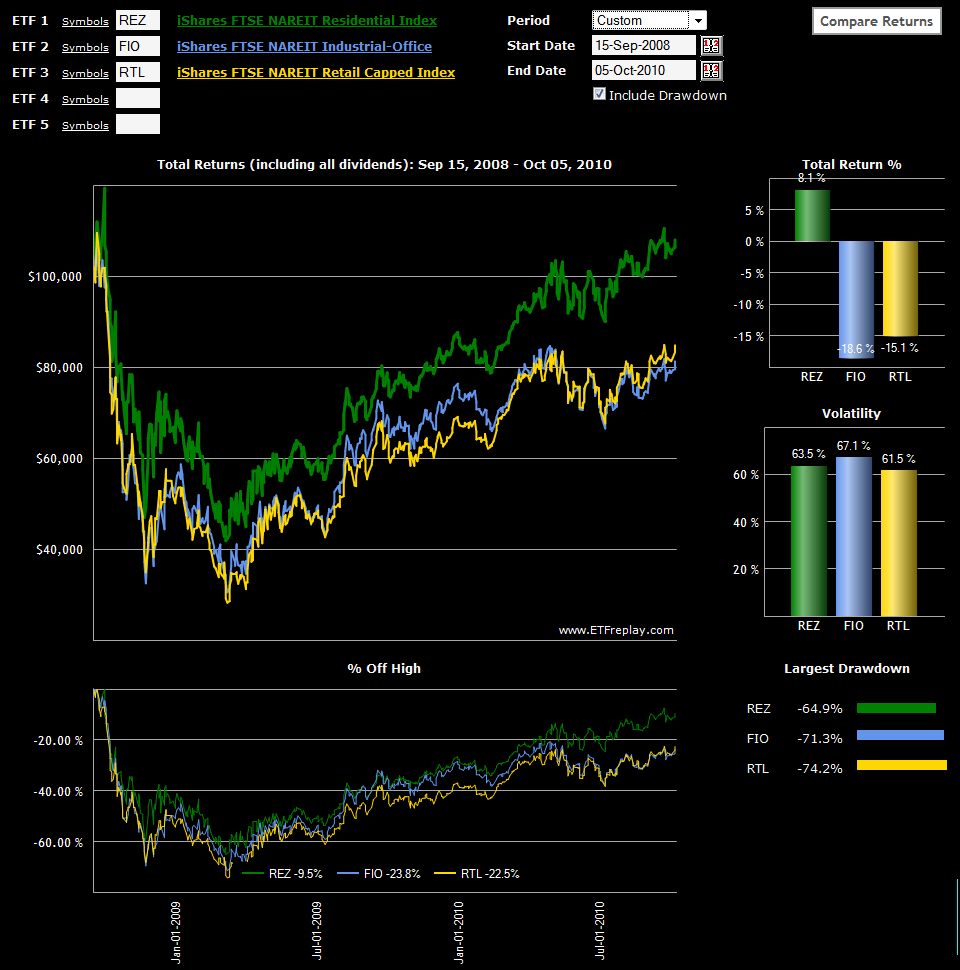

Specifically, Andrew asked about the FTSE NAREIT Residential Plus Capped Index Fund (REZ) and wondered if apartments were behind the relative outperformance of this real estate ETF.

My reply noted that the three largest components of REZ are:

- Apartments – 47%

- Health care – 37%

- Self storage – 13%

Of course, as homeowners migrate to apartments, they are typically downsizing in terms of square feet of living space, which is also increasing the demand for self-storage facilities. When you add together the 47% of REZ that is accounted for by apartments and 13% that is attributed to self storage, the result of the move from homes to apartments is a paradox of sorts in which the REZ ETF as currently structured should perform particularly well in a deteriorating residential real estate market.

Seen in this light, there is little wonder that REZ has outperformed its counterparts, RTL and FIO, which are focused primarily on shopping centers and offices, respectively.

Finally, on a housekeeping note, I am making a concerted effort to keep up with my Seeking Alpha private mailbox and comments, just as I do with private emails and comments on the blog. At the moment I am a little behind, but if you have some outstanding questions and comments, I expect to get caught up in the next day or two.

Related posts:

- Commercial Real Estate Sub-Sector Breakout

- Updating the Commercial Real Estate Picture

- The Looming Commercial Real Estate Crisis

- Commercial Real Estate Blogs

- Three Commercial Real Estate Sub-Sector ETFs to Watch

- Moodys/REAL Commercial Property Price Index

- Commercial Real Estate Problems Piling Up