Guest Columnist at The Striking Price for Barron’s: How to Spot Risk Early

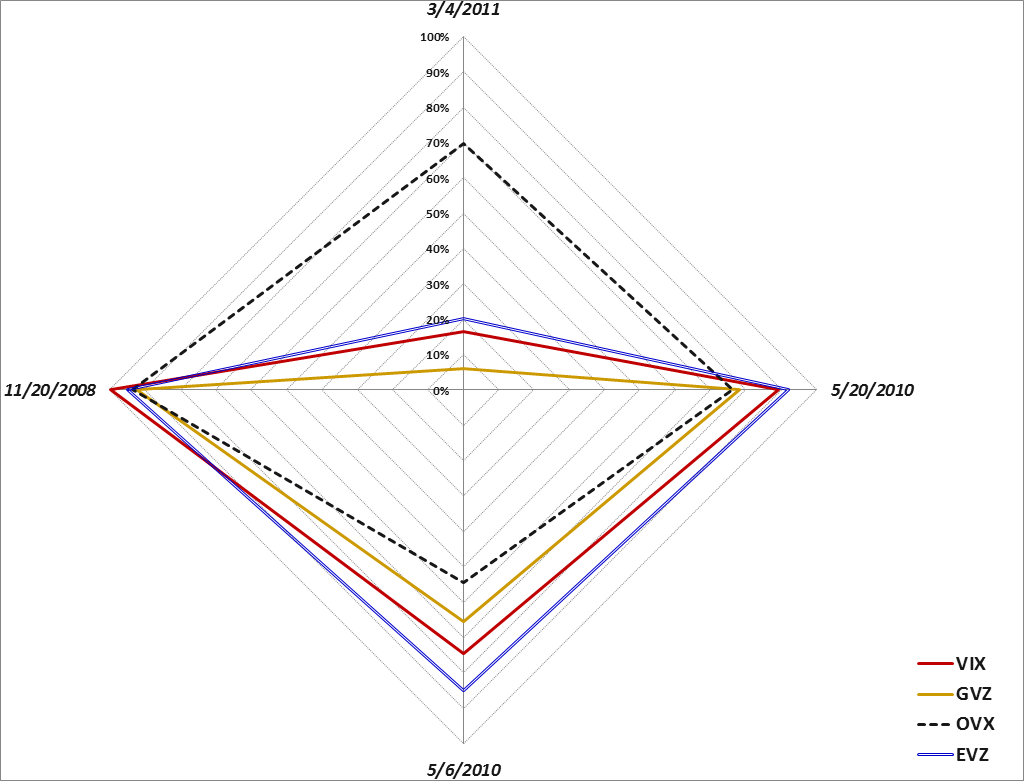

Today’s guest column, How to Spot Risk Early, at The Striking Price on behalf of Steven Sears at Barron’s, is the eleventh time I have had the opportunity to write a column for Barron’s. Today’s column picks up on a theme I addressed in a March 2011 article in Expiring Monthly which was titled, Evaluating Volatility Across Asset Classes. In that 2011 article, I introduce the concept of a volatility compass as a framework for evaluating the different types of volatility spikes that were seen in the 2008 financial crisis, the euro zone crisis as of May 2010, the Arab Spring in March 2011, and the May 6, 2010 flash crash.

[Volatility compass showing different levels of volatility across asset classes during four recent spikes in volatility. Source(s):VIX and More]

In the 2011 article I provide an overview of my thinking as follows:

“It is my belief that a better understanding of the volatility picture across asset classes will yield a better grasp of volatility events and help to identify a number of favorable trading setups.”

Later on I conclude the article with the following thoughts:

“For those who have studied sector rotation strategies and methods for trading geography-based ETFs, some of the analytical techniques used in those two disciplines can be carried over to an analysis of cross asset class volatility.

Ultimately, the study of volatility has both a science and art component to it, but a cross asset class approach provides a more broad-based holistic view of the volatility landscape and adds a little more science to the mix.

At some point, volatility becomes the study largely of contagion and falling dominoes. I can say without hesitation that a multi-disciplinary approach is essential to understanding contagion and dominoes and that a cross asset class analytical framework supplemented by tools such as the volatility compass is an effective way to approach that subject.”

In today’s Barron’s article, I expand upon the idea of four types of volatility indices and address volatility indices that provide a snapshot of geographical uncertainty and risk as well as broader measures of uncertainty and risk across asset classes such as U.S. Treasury Notes and currencies.

I will have more on this subject in the future, but for those interested in researching some of these subjects, I have highlighted some previous posts on different ways of thinking about uncertainty, risk and volatility below.

Related posts:

- VXTYN Measures Volatility in U.S. Treasuries and Potential Spillover Effect

- VXEEM as a Measure of Emerging Markets Volatility and Risk

- Using DXJ to Monitor Development in Japanese Equities, Currency and Risk

- The Currency Carry Trade, DBV and Risk

- Chart of the Week: U.S. 10-Year Treasury Note Yields from 1990

- Treasury Yield Curve ETNs and Volatility

- Chart of the Week: Ratio of VIX to Yield on 3-Month T-Bills

- Recent Developments in Gold and Gold Volatility

- EuroCurrency Volatility Index (EVZ) at Lowest Level Since March 2008, Diverges from VIX

- Chart of the Week: Crude Oil and Volatility

- The Risk Library

- A Conceptual Framework for Volatility Events

- Forces Acting on the VIX

- St. Louis Fed’s Financial Stress Index

A full list of my Barron’s contributions:

- How to Spot Risk Early (July 16, 2013)

- How to Insure Your Stock Portfolio (April 18, 2013)

- The Case for Options Trading (January 2, 2013)

- Calm Down and Exploit Others’ Anxieties (November 14, 2012)

- How to Trade Options Around Volatile Events (July 10, 2012)

- Be Greedy While Others Are Fearful (May 3, 2012)

- Ways to Turn Volatility into an Asset Class (January 12, 2011)

- There’s Opportunity in Uncertainty (November 18, 2010)

- Will Market Volatility Return to Crisis Levels? (September 15, 2010)

- The Perils of Predicting Volatility (May 20, 2010)

- Take a Longer View on Volatility (July 2, 2009)

Disclosure(s): none