Guest Columnist at The Striking Price for Barron’s: Why I Am Short Fear

Today I am a guest columnist for The Striking Price on behalf of Steven Sears at Barron’s, weighing in with Be Greedy While Others Are Fearful.

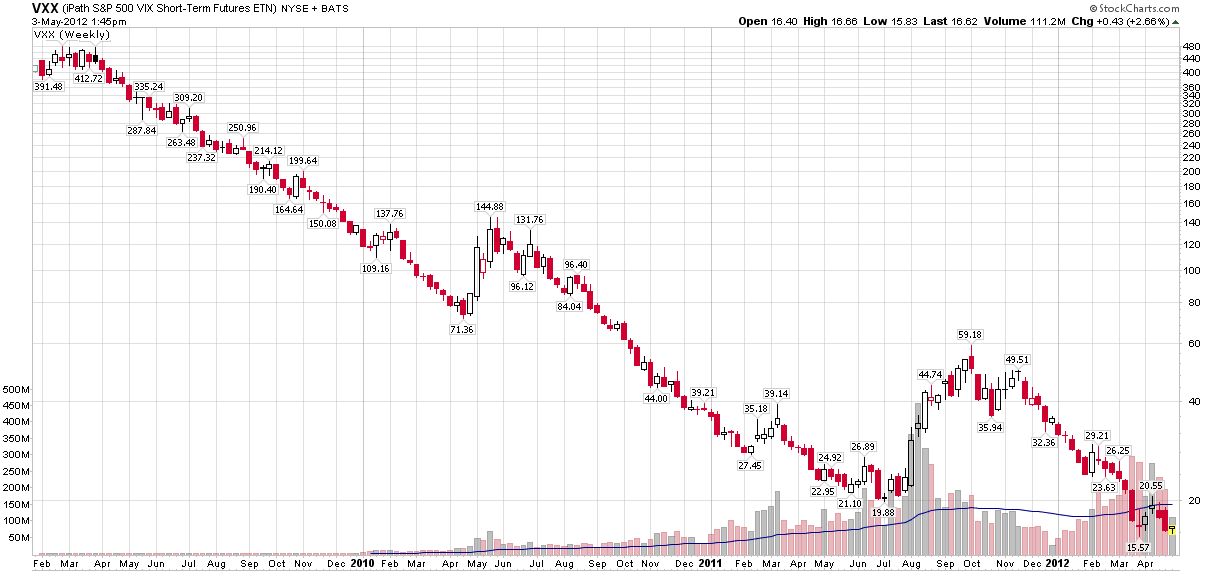

The Barron’s article is a quick summary of some of the reasons I am short fear. Essentially, I am short fear not because I have a Panglossian view of the world and am unconcerned about events in Spain, China, Iran and other global flash points, but rather because fear is almost always overpriced – and by a wide margin. Between the volatility risk premium and persistent negative roll yield, long VIX strategies generally face an uphill battle.

I spell out the details of my thinking in the Barron’s article, but readers can find some similar themes in the links below.

Related posts:

- VIX Premium to SPX Historical Volatility at Record High in Q1

- S&P 500 Index 20-Day Historical Volatility Hits 39-Year Low

- VIX and Historical Volatility Settling Back into Normal Range

- The Gap Between the VIX and Realized Volatility

- Chart of the Week: No More Free Lunch for Volatility Sellers?

- Availability Bias and Disaster Imprinting

- VIX Data to Support Availability Bias and Disaster Imprinting Hypothesis

- Thinking About Volatility (First in a Series)

A full list of my Barron’s contributions:

- Be Greedy While Others Are Fearful (May 3, 2012)

- Ways to Turn Volatility into an Asset Class (January 12, 2011)

- There’s Opportunity in Uncertainty (November 18, 2010)

- Will Market Volatility Return to Crisis Levels? (September 15, 2010)

- The Perils of Predicting Volatility (May 20, 2010)

- Take a Longer View on Volatility (July 2, 2009)

[source(s): StockCharts.com]

Disclosure(s): short VXX at time of writing