All About the Pullback from SPX 1687

Today the S&P 500 index fell 2.5% and at its low was more than 102 points lower than the all-time high of 1687.18 from May 22nd. At times like this I am amazed by how many requests I get to update the table of pullbacks I have been posting periodically since the current bull market began in March 2009.

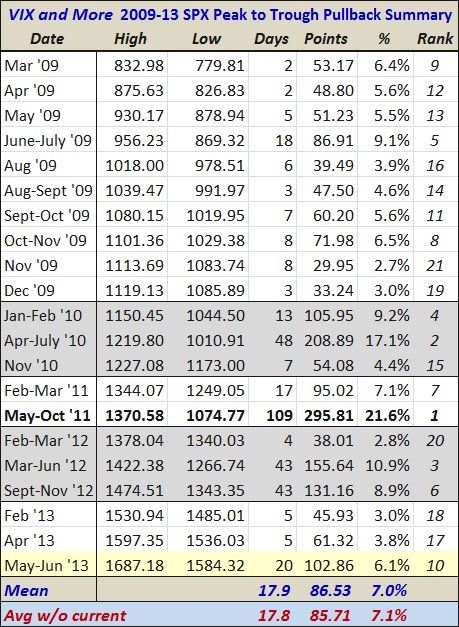

As the table below shows, the current peak-to-trough decline represents a 6.1% pullback from the all-time high and ranks tenth of twenty-one pullbacks during this period. The mean pullback during this bull market is 7.0% and would suggest a bottom of SPX 1568. The median pullback is only 5.6% and would have brought the index down to 1593.

This is not to say that there is a specified amount of suffering that the bulls must be subject to before stocks should feel to rebound or that there is a certain amount of time that the bulls should spend in the penalty box (the mean peak-to-trough decline lasts 18 days, while the median is 7 days), but at some point the severity of the pullback will begin to attract more buyers and increase the odds that the tide will turn.

[source(s): CBOE, Yahoo, VIX and More]

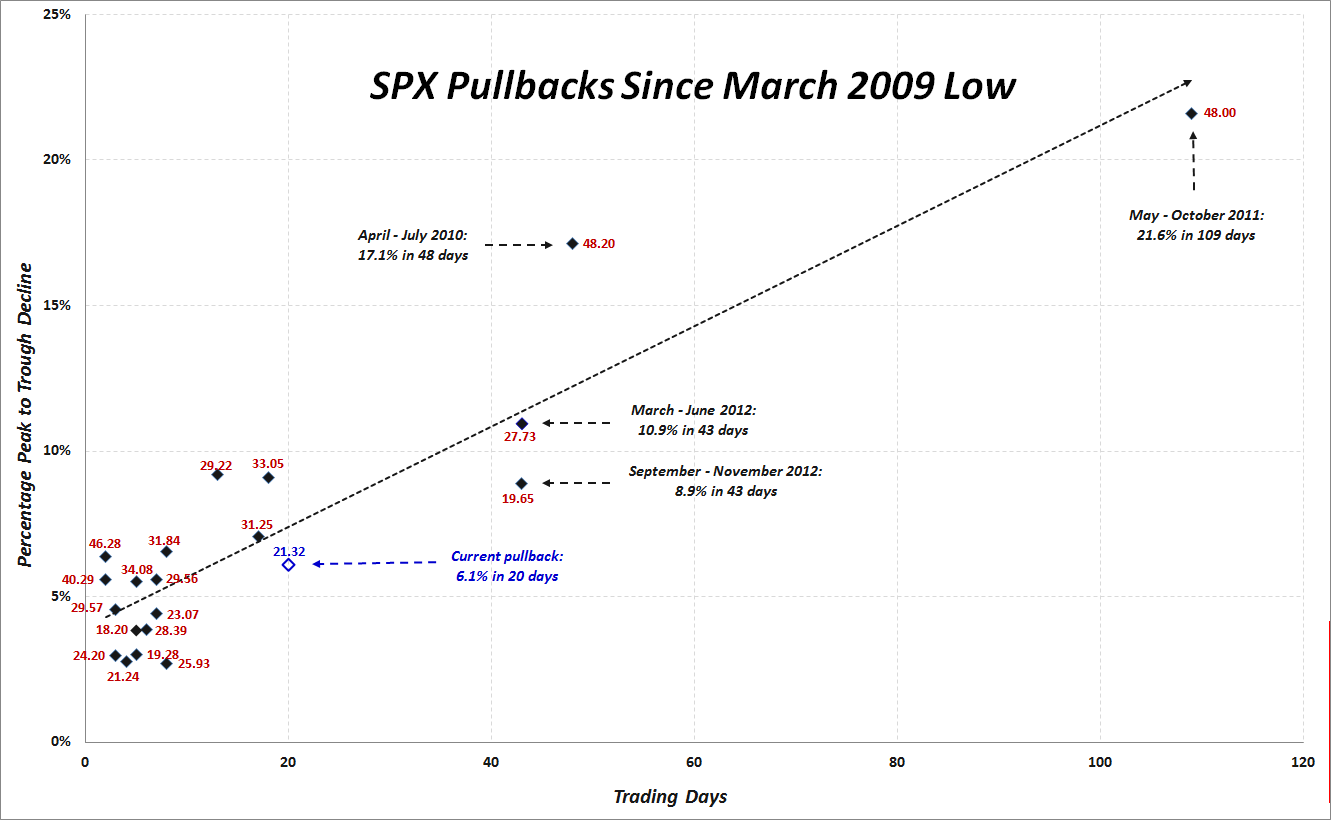

For those who prefer their data crammed into one graphic, I have also updated an annotated plot in which the y-axis captures the magnitude of the peak-to-trough decline (inverted) and the x-axis records the duration of that move. I have also included the peak VIX during the pullback as a red label for each dot and a long dotted black line as the best linear fit of all the data points.

Note that the current pullback is already the fifth longest in four plus years and while it has made quite a splash so far, there is only a 3.87 point cushion from today’s close to the intraday low before the pullback officially becomes longer in the tooth and more severe.

[source(s): CBOE, Yahoo, VIX and More]

Disclosure(s): none