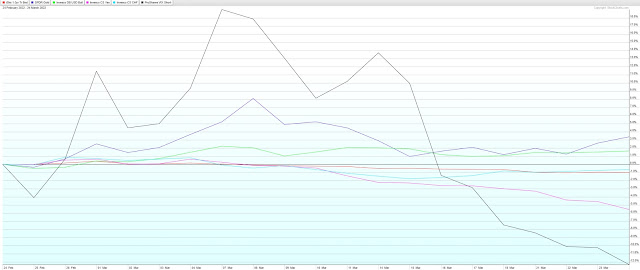

Flight-to-Safety ETP Performance During Invasion of Ukraine

Russia invaded Ukraine a little over a month ago, creating turmoil and panic in stocks and across a wide variety of asset classes and instruments.

In the graphic below, I capture the performance of ETPs covering a variety of

traditional flight-to-safety instruments that are used to de-risk or hedge an equity-centric

portfolio. These include:

SHY: 1-3 Year

Treasuries (solid red line)

GLD: Gold (dark

purple line)

UUP: U.S. Dollar

(light green line)

FXY: Japanese

Yen (violet line)

FXF: Swiss Franc

(light blue line)

VIXY: Short-Term

VIX Futures (black line)

Note that normally I would use VXX, but the price distortions due to the suspension of new creation units makes VIXY a more accurate measure.

The graphic shows that none of the ETPs above turned in particularly strong performance. Long volatility has been the best performer

for the first two weeks, but is now down more than the S&P 500 Index, with

a loss of over 12%. The top performer

for the entire period is gold, which has had a fairly steady if unremarkable

return during this period. The second-best

performer is the dollar, which has seen a steady upside, but has consistently

trailed gold. Three ETPs have also

generated losses, following a slight uptick the first few days. The worst performer has been the Japanese yen

and the other underperformers have been the Swiss Franc and 1-3 Year Treasuries.

All in all, these traditional or generic hedges have been a disappointment. In my next post, I will look at some hedges that are better suited to the Russia-Ukraine situation and have delivered much better results.

[source(s): StockCharts.com]

Further

Reading:

Safe

Haven Options Shrinking?

Chart

of the Week: Flight-to-Safety ETPs

Revisiting

the Flight-to-Safety Trade

Chart

of the Week: The Flight-to-Safety Trade

Why

Not Point Hedges?

Forces

Acting on the VIX

A

Conceptual Framework for Volatility Events

While it has not been updated in a while, new readers may also enjoy older

posts that have been tagged with the Hall of

Fame label.

For those who may be interested, you can always follow me on Twitter at @VIXandMore

Disclosure(s): Net short VXX and long GLD and SHY at time of

writing